Question: How is the first question in problem 4 solved using a financial calculator? I am entering N=15, I/Y=8, PMT=5,450 at 1 payment per year but

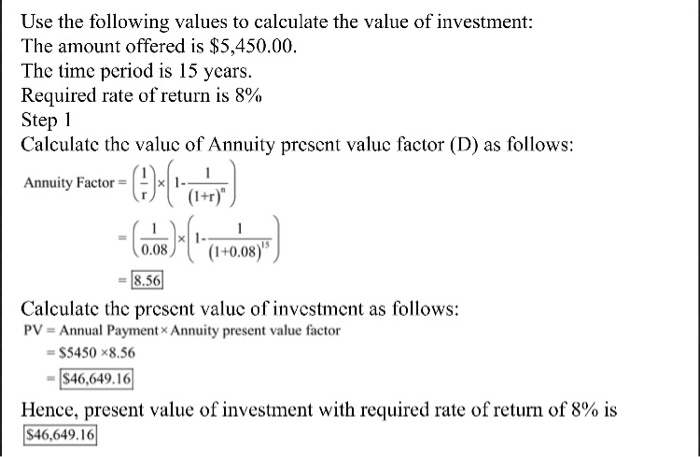

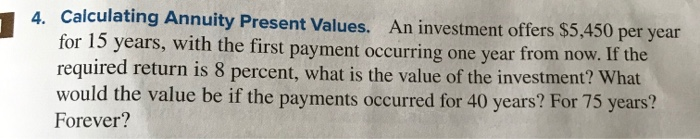

Use the following values to calculate the value of investment: The amount offered is $5,450.00. The time period is 15 years. Required rate of return is 8% Step 1 Calculate the value of Annuity present value factor (D) as follows: Anmity Factor- Annuity Factor - (ODS)**1+0.08)" = 8.56 Calculate the present value of investment as follows: PV = Annual Payment Annuity present value factor =S5450 8.56 -S46,649.16 Hence, present value of investment with required rate of return of 8% is S46,649.16 4. Calculating Annuity Present Values. An investment offers $5,450 per year for 15 years, with the first payment occurring one year from now. If the required return is 8 percent, what is the value of the investment? What would the value be if the payments occurred for 40 years? For 75 years? Forever

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts