Question: How is the total cash flow and PV calculated? Machine Sale foregone Tax on machine sale foregone Revised machine sale Revised machine tax savings Contract

How is the total cash flow and PV calculated?

How is the total cash flow and PV calculated?

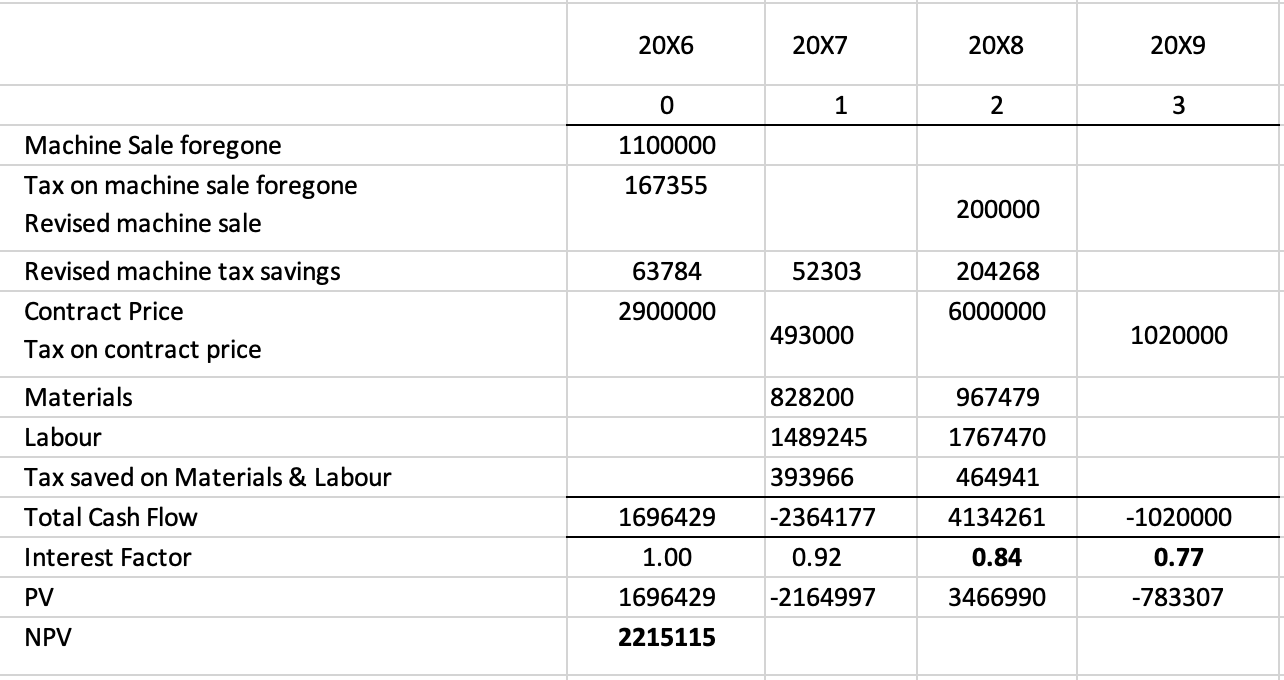

Machine Sale foregone Tax on machine sale foregone Revised machine sale Revised machine tax savings Contract Price Tax on contract price Materials Labour Tax saved on Materials & Labour Total Cash Flow Interest Factor PV NPV 20X6 20X7 0 1 1100000 167355 63784 52303 2900000 493000 828200 1489245 393966 1696429 -2364177 1.00 0.92 1696429 -2164997 2215115 20X8 2 200000 204268 6000000 967479 1767470 464941 4134261 0.84 3466990 20X9 3 1020000 -1020000 0.77 -783307

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock