Question: how is this solved? Question No 2 (7 marks) Consider the following information: Probability Return of Stock XYZ State of the Economy Good Very Good

how is this solved?

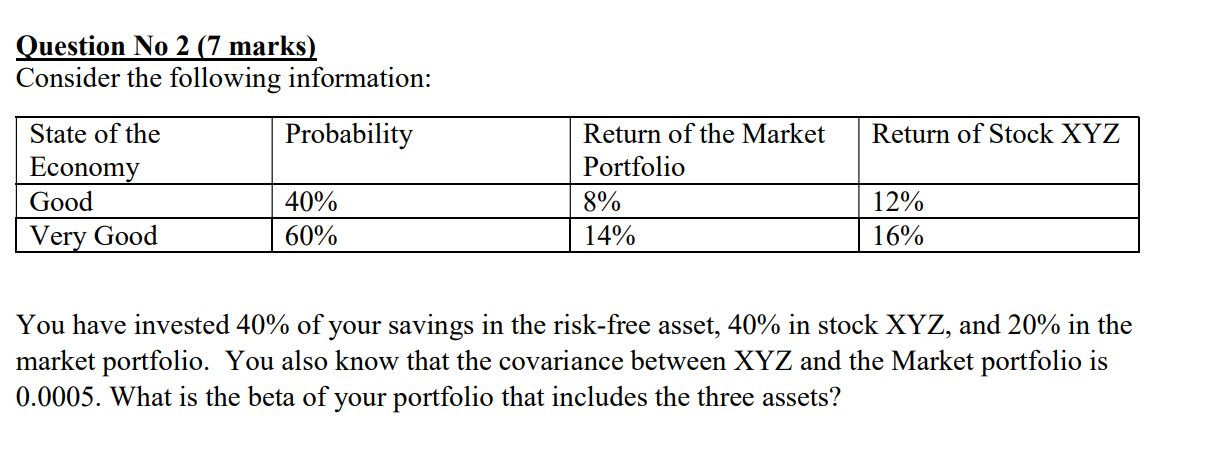

Question No 2 (7 marks) Consider the following information: Probability Return of Stock XYZ State of the Economy Good Very Good Return of the Market Portfolio 8% 14% 40% 60% 12% 16% You have invested 40% of your savings in the risk-free asset, 40% in stock XYZ, and 20% in the market portfolio. You also know that the covariance between XYZ and the Market portfolio is 0.0005. What is the beta of your portfolio that includes the three assets

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock