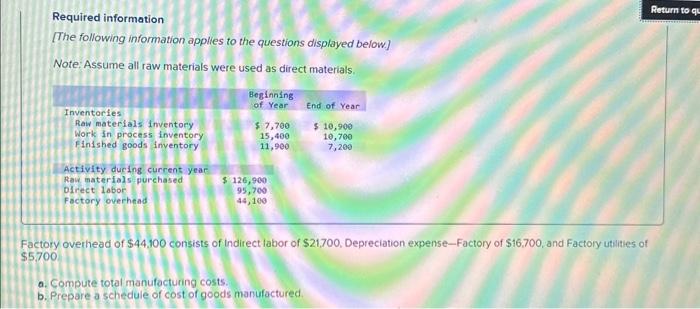

Question: How is this wrong ?? a. compute total manufacturing costs. b. prepare a schedule of cog manufactured Required information [The following information applies to the

![to the questions displayed below] Note: Assume all raw materials were used](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f6ca10d7482_61666f6ca1042660.jpg)

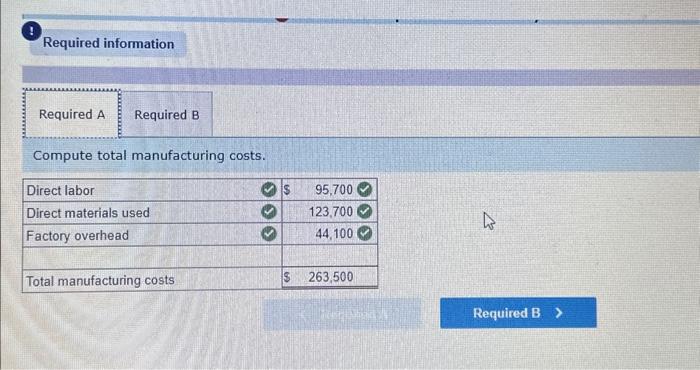

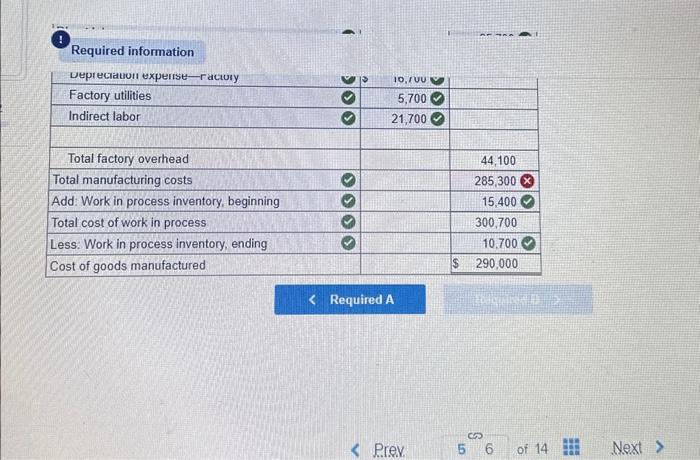

Required information [The following information applies to the questions displayed below] Note: Assume all raw materials were used as direct materials. ctory overhead of $44,100 consists of Indirect labor of $21,700, Depreciation expense-Factory of $16,700, and Factory utsilies of 5700 a. Compute total manufacturing costs. b. Prepare a schedule of cost of goods manufactured Compute total manufacturing costs. Sheck my work mode: This shows what is correct or incorrect for the work you have completed Prepare a schedule of cost of goods manufactured. Required information \begin{tabular}{|c|c|c|c|} \hline & & & \\ \hline & & 5,700 & \\ \hline Indirect labor & & 21,700 & \\ \hline Total factory overhead & & & 44,100 \\ \hline Total manufacturing costs & 0 & & 285,300 \\ \hline Add: Work in process inventory, beginning & 0 & & 15,400 \\ \hline Total cost of work in process & 0 & & 300,700 \\ \hline Less: Work in process inventory, ending & 0 & & 10.700 \\ \hline Cost of goods manufactured & & & $290,000 \\ \hline \end{tabular} Required A Prev 56 of 14 Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts