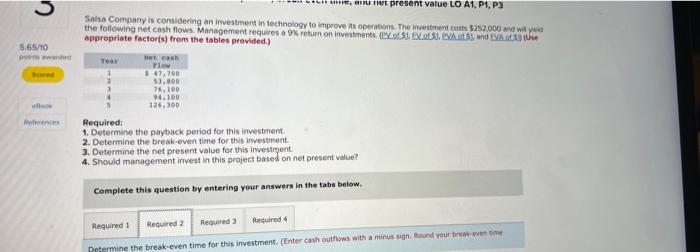

Question: how is this wrong ou met present value LO A1, P1, P3 Salsa Company is considering an investment in technology to improve its operations. The

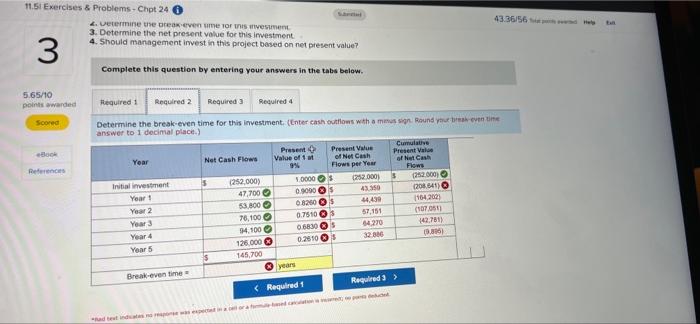

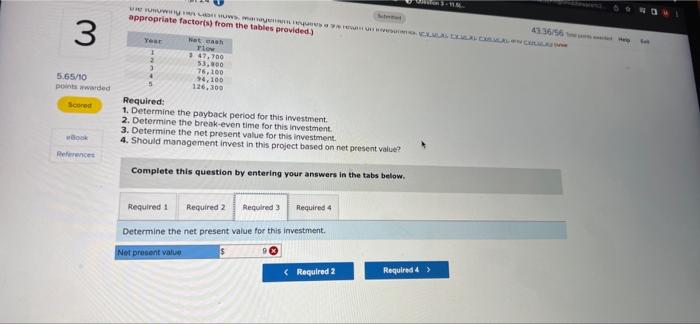

ou met present value LO A1, P1, P3 Salsa Company is considering an investment in technology to improve its operations. The investment costs 5252.000 and will the following net cash flows. Management requires a return on investments BV S. EX.01. DVA OS and VAO appropriate factors) from the tables provided) 5.65/10 Downlod Swed Year eta Flow 347,700 53,000 3 74.100 94.100 126,360 Required: 1. Determine the payback period for this investment 2. Determine the break-even time for this investment 3. Determine the net present value for this investment 4. Should management invest in this project based on net present value? Berences Complete this question by entering your answers in the tabs below. Required 2 Required 1 Required 3 Required Determine the break-even time for this investment. (Enter cash outflows with a minus sign. Round your browseven time 43 36/56 11.51 Exercises & Problems - Chpt 24 O 2. Determine the revenumeror this tivement 3. Determine the net present value for this investment 4. Should management invest in this project based on net present value? 3 Complete this question by entering your answers in the tabs below. 5.65/10 points awarded Scored door References Required 1 Required 2 Required Required 4 Determine the break-even time for this investment (Enter cushootlows with a minus sign. Round your entine answer to 1 decimal place) Present Present Value Cumulate Year Net Cash Flow Value of 1 of Net Cash Presentace 9% Flows per Yes of the Cash Flows Initial investment 5 (252,000) 10000 C252.000 0752.0001 Year 47,700 0.0000 43.550 1208.841) Year 2 53.800 08250 $ 4.430 1164.2021 Year 76,100 0.7510 57.151 (107051 Year 4 94.100 0.68305 64270 142.781) 126.000 Years 2006 0.2810 145.700 Break-even time year $ . RowWwW.YOULOUW appropriate factors) from the tables provided) 3 5.65/10 points warded 4 5 Not aan Year Po 347.700 53.100 76.100 14,100 126.300 Required: 1. Determine the payback period for this investment 2. Determine the break-even time for this investment 3. Determine the net present value for this investment 4. Should management invest in this project based on net present value? Scores References Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required Required Determine the net present value for this investment. Not procent value 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts