Question: How is WACC calculated in this document? Could you please write down the detailed steps of WACC for me? Thank you How is WACC calculated

How is WACC calculated in this document? Could you please write down the detailed steps of WACC for me? Thank you

How is WACC calculated in this document? Could you please write down the detailed steps of WACC for me? Thank you

How is WACC calculated in this document? Could you please write down the detailed steps of WACC for me? Thank you

How is WACC calculated in this document? Could you please write down the detailed steps of WACC for me? Thank you

How is WACC calculated in this document? Could you please write down the detailed steps of WACC for me? Thank you

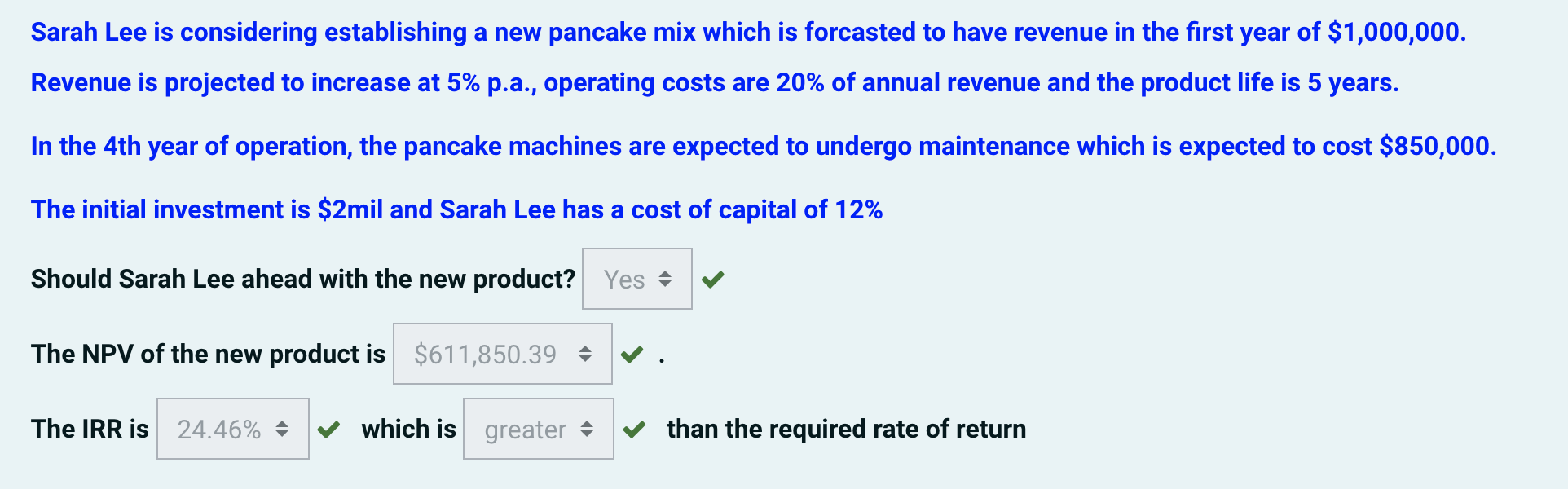

Sarah Lee is considering establishing a new pancake mix which is forcasted to have revenue in the first year of $1,000,000. Revenue is projected to increase at 5% p.a., operating costs are 20% of annual revenue and the product life is 5 years. In the 4th year of operation, the pancake machines are expected to undergo maintenance which is expected to cost $850,000. The initial investment is $2mil and Sarah Lee has a cost of capital of 12% Should Sarah Lee ahead with the new product? Yes - The NPV of the new product is $611,850.39 - The IRR is 24.46% - which is greater - than the required rate of return Sarah Lee is considering establishing a new pancake mix which is forcasted to have revenue in the first year of $1,000,000. Revenue is projected to increase at 5% p.a., operating costs are 20% of annual revenue and the product life is 5 years. In the 4th year of operation, the pancake machines are expected to undergo maintenance which is expected to cost $850,000. The initial investment is $2mil and Sarah Lee has a cost of capital of 12% Should Sarah Lee ahead with the new product? Yes - The NPV of the new product is $611,850.39 - The IRR is 24.46% - which is greater - than the required rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts