Question: How is working capital calculated? a. current assets * current liabilities b. current assets minus current liabilities c. current assets plus current liabilities d. current

How is working capital calculated?

a.

current assets * current liabilities

b.

current assets minus current liabilities

c.

current assets plus current liabilities

d.

current assets / current liabilities

2) Which of the following evaluates data over a period of time?

a.

ratio analysis

b.

financial analysis

c.

vertical analysis

d.

horizontal analysis

3) Which of the following applies to ratio analysis?

a.

it uses financial statement data from the same accounts and compares it to different years

b.

it eliminates the size difference

c.

it uses financial statement data from the same year but compares it to different accounts

d.

it is used to evaluate profitability, liquidity, and solvency.

Part c

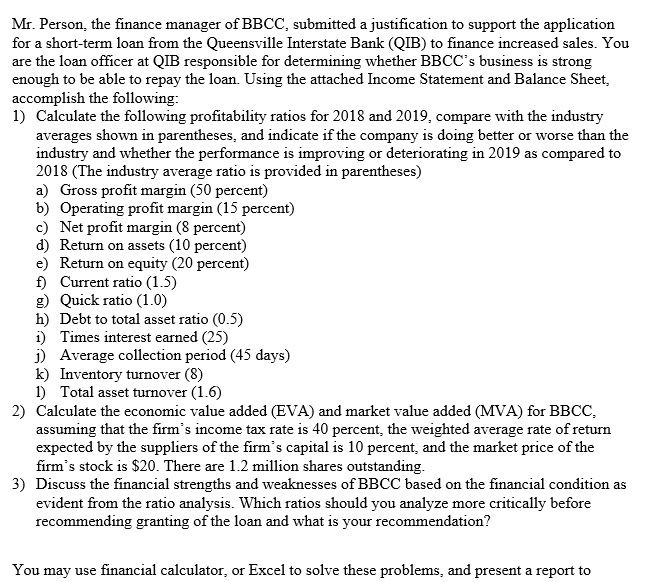

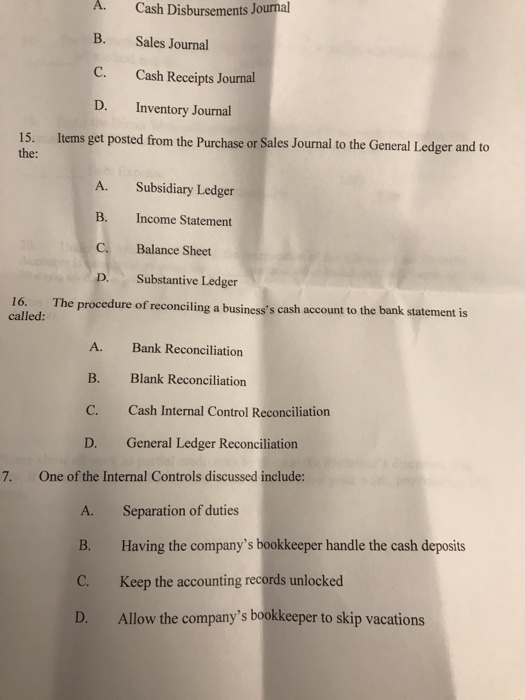

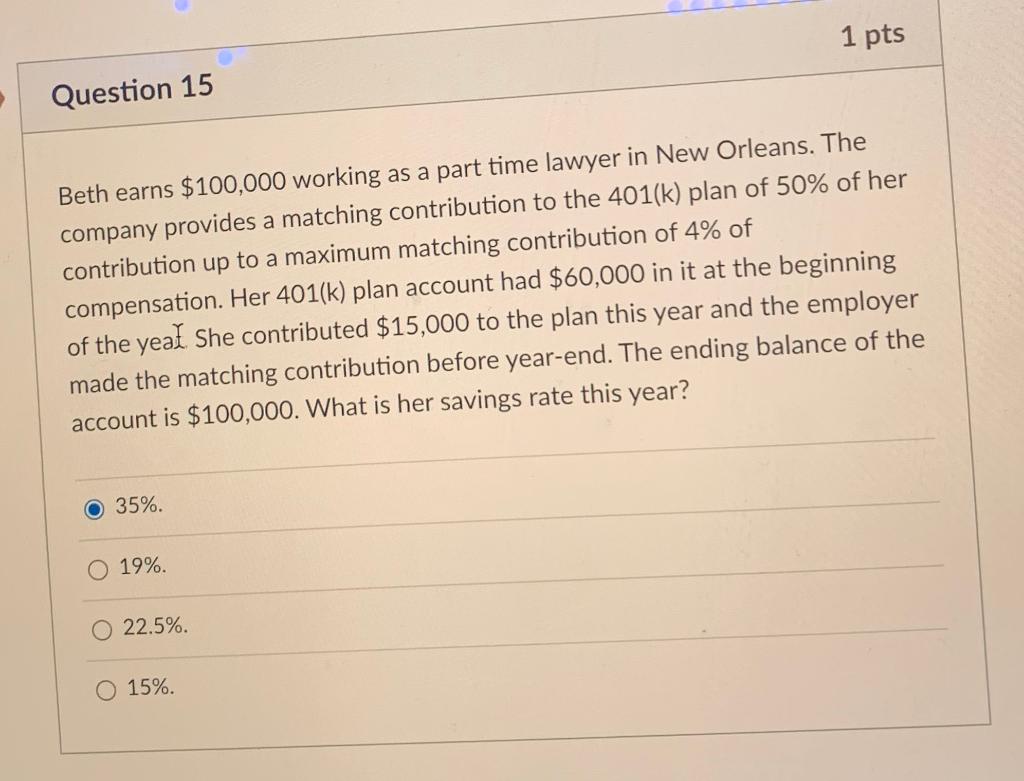

Mr. Person, the finance manager of BBCC, submitted a justification to support the application for a short-term loan from the Queensville Interstate Bank (QIB) to finance increased sales. You are the loan officer at QIB responsible for determining whether BBCC's business is strong enough to be able to repay the loan. Using the attached Income Statement and Balance Sheet, accomplish the following: 1) Calculate the following profitability ratios for 2018 and 2019, compare with the industry averages shown in parentheses, and indicate if the company is doing better or worse than the industry and whether the performance is improving or deteriorating in 2019 as compared to 2018 (The industry average ratio is provided in parentheses) a) Gross profit margin (50 percent) b) Operating profit margin (15 percent) c) Net profit margin (8 percent) d) Return on assets (10 percent) e) Return on equity (20 percent) f) Current ratio (1.5) g) Quick ratio (1.0) h) Debt to total asset ratio (0.5) 1) Times interest earned (25) Average collection period (45 days) k) Inventory turnover (8) 1) Total asset turnover (1.6) 2) Calculate the economic value added (EVA) and market value added (MVA) for BBCC, assuming that the firm's income tax rate is 40 percent, the weighted average rate of return expected by the suppliers of the firm's capital is 10 percent, and the market price of the firm's stock is $20. There are 1.2 million shares outstanding 3) Discuss the financial strengths and weaknesses of BBCC based on the financial condition as evident from the ratio analysis. Which ratios should you analyze more critically before recommending granting of the loan and what is your recommendation? You may use financial calculator, or Excel to solve these problems, and present a report toA. Cash Disbursements Journal B. Sales Journal C. Cash Receipts Journal D. Inventory Journal 15. Items get posted from the Purchase or Sales Journal to the General Ledger and to the: A. Subsidiary Ledger B. Income Statement 20 C. Balance Sheet D. Substantive Ledger 16. The procedure of reconciling a business's cash account to the bank statement is called: A. Bank Reconciliation B. Blank Reconciliation C. Cash Internal Control Reconciliation General Ledger Reconciliation 7. One of the Internal Controls discussed include: A. Separation of duties B. Having the company's bookkeeper handle the cash deposits C. Keep the accounting records unlocked D. Allow the company's bookkeeper to skip vacationsQuestion 15 1 pts Beth earns $100,000 working as a part time lawyer in New Orleans. The company provides a matching contribution to the 401(k) plan of 50% of her contribution up to a maximum matching contribution of 4% of compensation. Her 401(k) plan account had $60,000 in it at the beginning of the year She contributed $15,000 to the plan this year and the employer made the matching contribution before year-end. The ending balance of the account is $100,000. What is her savings rate this year? O 35%. O 19%. O 22.5%. O 15%