Question: How it was solved shown above is incorrect. Thermal Rising, Incorporated, makes paragliders for sale through specialty sporting goods stores. The company has a standard

How it was solved shown above is incorrect.

How it was solved shown above is incorrect.

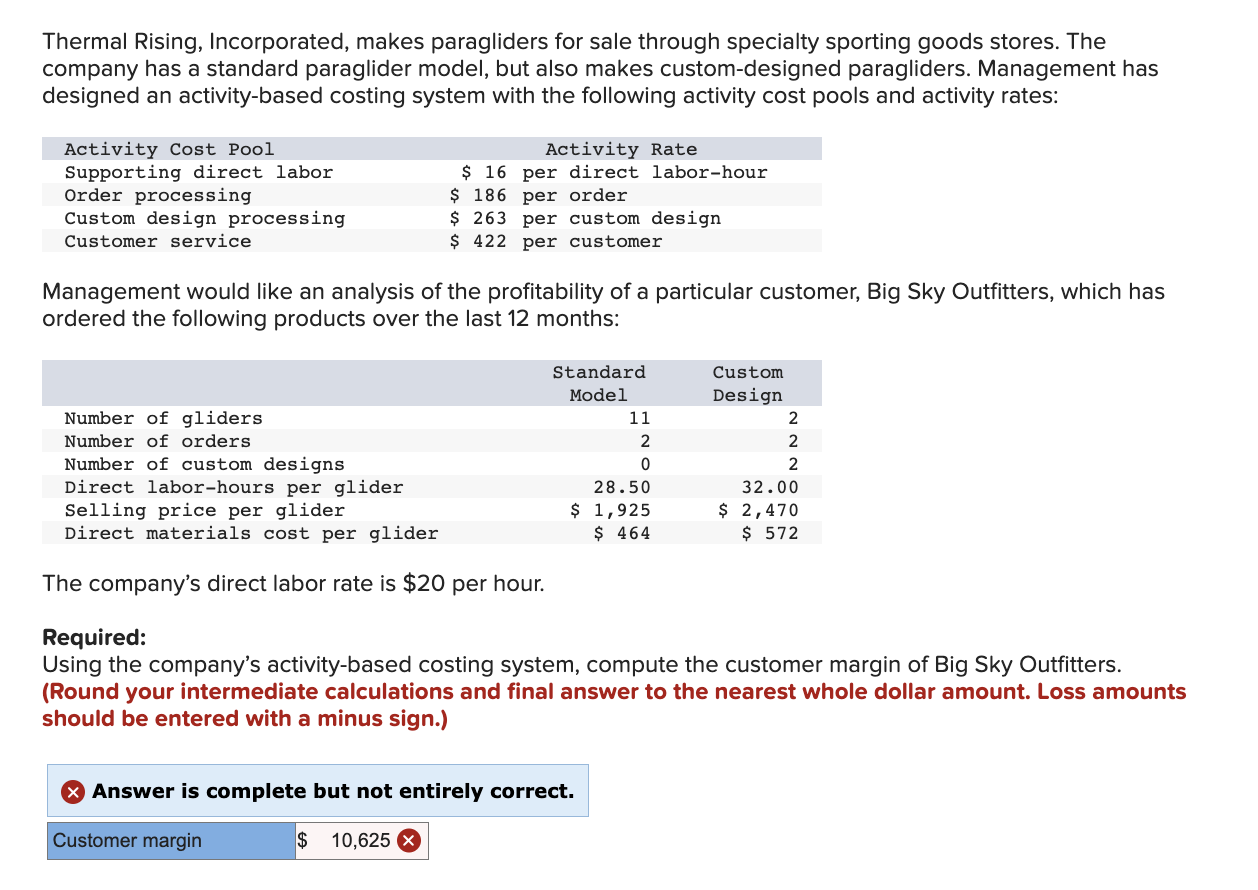

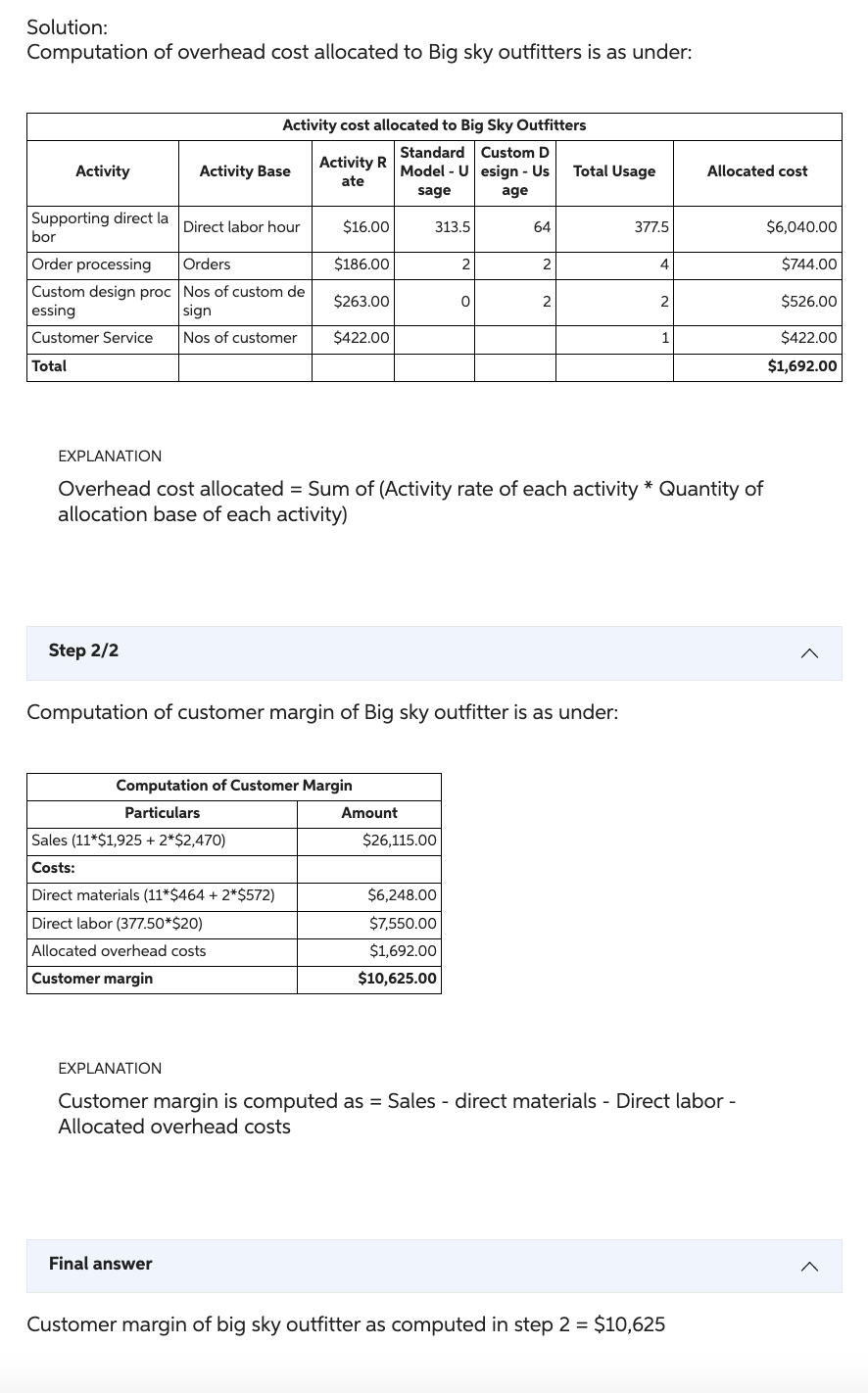

Thermal Rising, Incorporated, makes paragliders for sale through specialty sporting goods stores. The company has a standard paraglider model, but also makes custom-designed paragliders. Management has designed an activity-based costing system with the following activity cost pools and activity rates: Management would like an analysis of the profitability of a particular customer, Big Sky Outfitters, which has ordered the following products over the last 12 months: The company's direct labor rate is $20 per hour. Required: Using the company's activity-based costing system, compute the customer margin of Big Sky Outfitters. (Round your intermediate calculations and final answer to the nearest whole dollar amount. Loss amounts should be entered with a minus sign.) Answer is complete but not entirely correct. Solution: Computation of overhead cost allocated to Big sky outfitters is as under: Activitv cost allocated to Bia Skv Outfitters EXPLANATION Overhead cost allocated = Sum of ( Activity rate of each activity Quantity of allocation base of each activity) Step 2/2 Computation of customer margin of Big sky outfitter is as under: EXPLANATION Customer margin is computed as = Sales - direct materials - Direct labor - Allocated overhead costs Final answer Customer margin of big sky outfitter as computed in step 2=$10,625

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts