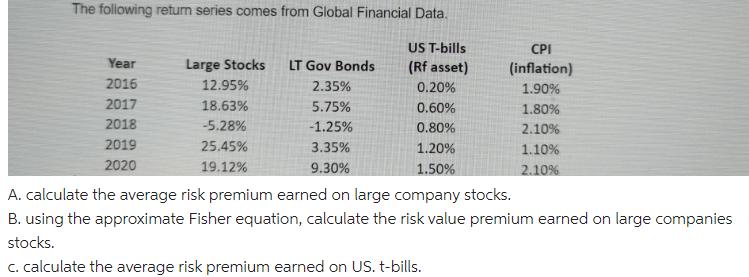

Question: The following return series comes from Global Financial Data. Year 2016 2017 2018 2019 2020 Large Stocks 12.95% 18.63% -5.28% 25.45% 19.12% LT Gov

The following return series comes from Global Financial Data. Year 2016 2017 2018 2019 2020 Large Stocks 12.95% 18.63% -5.28% 25.45% 19.12% LT Gov Bonds 2.35% 5.75% -1.25% 3.35% 9.30% US T-bills (Rf asset) 0.20% 0.60% 0.80% 1.20% 1.50% CPI (inflation) 1.90% 1.80% 2.10% 1.10% 2.10% A. calculate the average risk premium earned on large company stocks. B. using the approximate Fisher equation, calculate the risk value premium earned on large companies stocks. c. calculate the average risk premium earned on US. t-bills.

Step by Step Solution

3.47 Rating (167 Votes )

There are 3 Steps involved in it

A The average risk premium earned on large company stocks can be calculated by subtracting the avera... View full answer

Get step-by-step solutions from verified subject matter experts