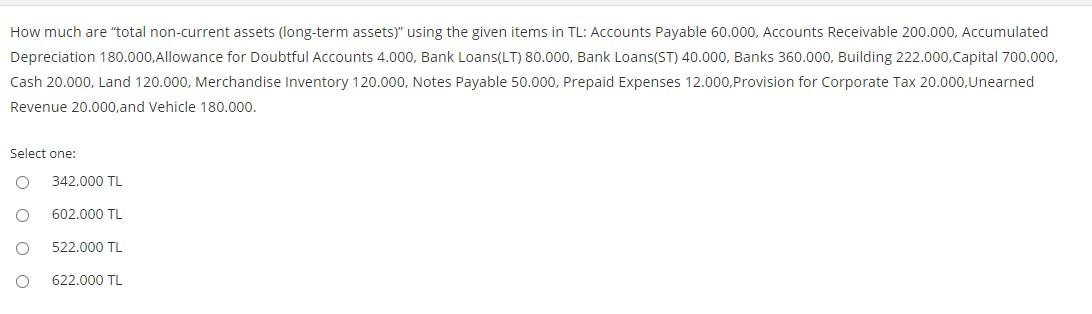

Question: How much are total non-current assets (long-term assets) using the given items in TL: Accounts Payable 60.000, Accounts Receivable 200.000, Accumulated Depreciation 180.000,Allowance for Doubtful

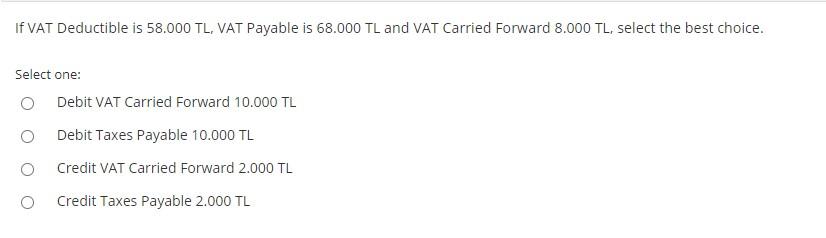

How much are "total non-current assets (long-term assets)" using the given items in TL: Accounts Payable 60.000, Accounts Receivable 200.000, Accumulated Depreciation 180.000,Allowance for Doubtful Accounts 4.000, Bank Loans(LT) 80.000, Bank Loans(ST) 40.000, Banks 360.000, Building 222.000.Capital 700.000, Cash 20.000, Land 120.000, Merchandise Inventory 120.000, Notes Payable 50.000, Prepaid Expenses 12.000, Provision for Corporate Tax 20.000, Unearned Revenue 20.000 and Vehicle 180.000. Select one: 342.000 TL 602.000 TL 522.000 TL 622.000 TL If VAT Deductible is 58.000 TL, VAT Payable is 68.000 TL and VAT Carried Forward 8.000 TL, select the best choice. Select one: Debit VAT Carried Forward 10.000 TL Debit Taxes Payable 10.000 TL Credit VAT Carried Forward 2.000 TL Credit Taxes Payable 2.000 TL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts