Question: How much external financing is needed for a 20% increase in sales if the Corporation is currently operating at full capacity? Assume assets and costs

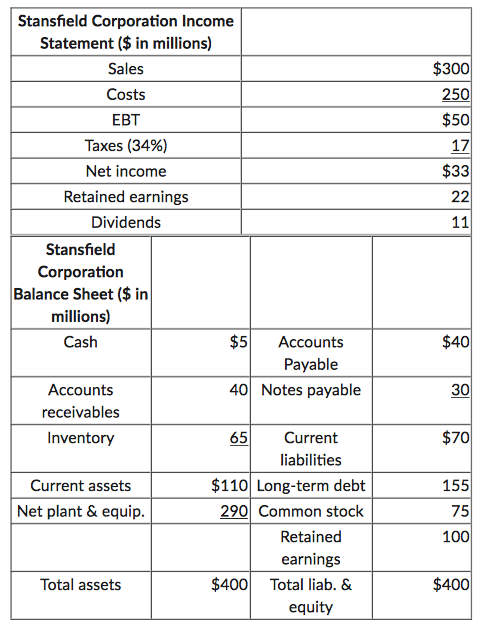

How much external financing is needed for a 20% increase in sales if the Corporation is currently operating at full capacity? Assume assets and costs vary directly with sales but no current liabilities increase with sales and that the dividend payout ratio remains fixed.

\begin{tabular}{|c|c|c|c|} \hline \multicolumn{2}{|c|}{\begin{tabular}{c} Stansfield Corporation Income \\ Statement ( $ in millions) \end{tabular}} & & \\ \hline \multicolumn{2}{|l|}{ Sales } & & $300 \\ \hline \multicolumn{2}{|l|}{ Costs } & & 250 \\ \hline \multicolumn{2}{|l|}{ EBT } & & $50 \\ \hline \multicolumn{2}{|c|}{ Taxes (34\%) } & & 17 \\ \hline \multicolumn{2}{|c|}{ Net income } & & $33 \\ \hline \multicolumn{2}{|c|}{ Retained earnings } & & 22 \\ \hline \multicolumn{2}{|c|}{ Dividends } & & 11 \\ \hline \multicolumn{4}{|l|}{\begin{tabular}{c} Stansfield \\ Corporation \\ Balance Sheet ( $ in \\ millions) \end{tabular}} \\ \hline Cash & $5 & \begin{tabular}{l} Accounts \\ Payable \end{tabular} & $40 \\ \hline \begin{tabular}{l} Accounts \\ receivables \end{tabular} & 40 & Notes payable & 30 \\ \hline Inventory & 65 & \begin{tabular}{l} Current \\ liabilities \end{tabular} & $70 \\ \hline Current assets & $110 & Long-term debt & 155 \\ \hline \multirow[t]{2}{*}{ Net plant \& equip. } & 290 & Common stock & 75 \\ \hline & & \begin{tabular}{l} Retained \\ earnings \end{tabular} & 100 \\ \hline Total assets & $400 & \begin{tabular}{l} Total liab. \& \\ equity \end{tabular} & $400 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts