Question: How much interest expense should Aggie record on the note for the first year? E. debit to machine for S122,135 DIEC OP 3,040 3. Determine

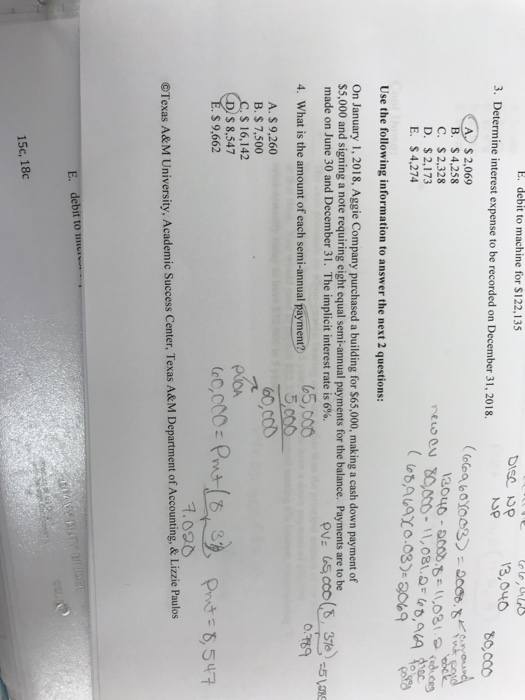

E. debit to machine for S122,135 DIEC OP 3,040 3. Determine interest expense to be recorded on December 31, 2018. 3p A S 2,069 B. $ 4,258 C. S 2.328 D. $2,173 E. $4,274 Use the following information to answer the next 2 questions: On January 1, 2018, Aggie Company purchased a building for $65,000, making a cash down payment of $5,000 and signing a note requiring eight equal semi-annual payments for the balance. Payments are to be made on June 30 and December 31, The implicit interest rate is 6%. 510 0.69 4. What is the amount of each semi-annual payment? A. S 9.260 B. S 7,500 S 16,142 S 8,547 s 9,662 (cc.cc0: (mt.175t 93, 1.020 Prn=5547 OTexas A&M University, Academic Success Center, Texas A& M Department of Accounting, & Lizzie Paulos debit to n 15c, 18c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts