Question: How much is the increase or decrease in doubtful debts expense for the year, indicate increase with + and decrease with - before the amount.

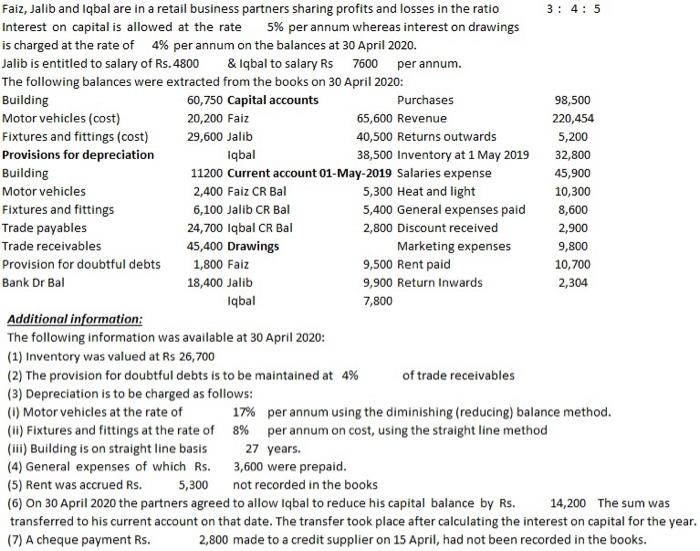

Faiz, Jalib and Iqbal are in a retail business partners sharing profits and losses in the ratio 3: 4: 5 Interest on capital is allowed at the rate 5% per annum whereas interest on drawings is charged at the rate of 4% per annum on the balances at 30 April 2020. Jalib is entitled to salary of Rs. 4800 & Iqbal to salary Rs 7600 per annum. The following balances were extracted from the books on 30 April 2020: Building 60,750 Capital accounts Purchases 98,500 Motor vehicles (cost) 20,200 Faiz 65,600 Revenue 220,454 Fixtures and fittings (cost) 29,600 Jalib 40,500 Returns outwards 5,200 Provisions for depreciation Iqbal 38,500 Inventory at 1 May 2019 32,800 Building 11200 Current account 01-May-2019 Salaries expense 45,900 Motor vehicles 2,400 Faiz CR Bal 5,300 Heat and light 10,300 Fixtures and fittings 6,100 Jalib CR Bal 5,400 General expenses paid 8,600 Trade payables 24,700 Iqbal CR Bal 2,800 Discount received 2,900 Trade receivables 45,400 Drawings Marketing expenses 9,800 Provision for doubtful debts 1,800 Faiz 9,500 Rent paid 10,700 Bank Dr Bal 18,400 Jalib 9,900 Return Inwards 2,304 Iqbal 7,800 Additional information: The following information was available at 30 April 2020: (1) Inventory was valued at Rs 26,700 (2) The provision for doubtful debts is to be maintained at 4% of trade receivables (3) Depreciation is to be charged as follows: (1) Motor vehicles at the rate of 17% per annum using the diminishing (reducing) balance method. (1) Fixtures and fittings at the rate of 8% per annum on cost, using the straight line method (HI) Building is on straight line basis 27 years. (4) General expenses of which Rs.3,600 were prepaid. (5) Rent was accrued Rs. 5,300 not recorded in the books (6) On 30 April 2020 the partners agreed to allow Iqbal to reduce his capital balance by Rs. 14,200 The sum was transferred to his current account on that date. The transfer took place after calculating the interest on capital for the year. (7) A cheque payment Rs. 2,800 made to a credit supplier on 15 April, had not been recorded in the books

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts