Question: How much joint cost ( in $ ) will be allocated to X1 using the NRV method? How much joint cost ( in $ )

How much joint cost (in $) will be allocated to X1 using the NRV method?

How much joint cost (in $) will be allocated to X2 using the NRV method?

How much is the total cost (in $) of X2?

What is the unit cost (in $) of X1?

What is the unit cost (in $) of X2?

What is the total operating income (in $) for selling all units produced of X1 and X2?

If X2 can already be sold for $2.14 at the split-off point*, what will be the resulting total operating income (in $) if management decides to sell X2 without further processing? (Note: No changes for the given data of X1.)

After comparing the computed total operating income/profits in the previous items, should management sell X2 at the split-off point or after processing it further?

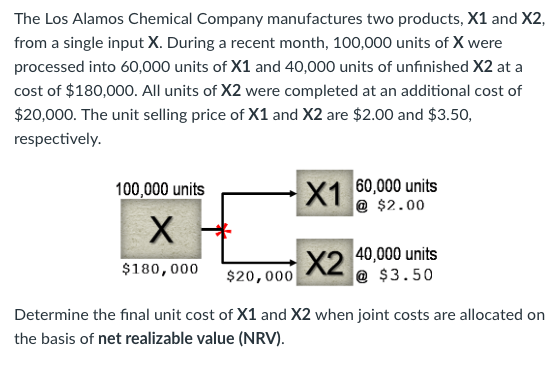

The Los Alamos Chemical Company manufactures two products, X1 and X2, from a single input X. During a recent month, 100,000 units of X were processed into 60,000 units of X1 and 40,000 units of unfinished X2 at a cost of $180,000. All units of X2 were completed at an additional cost of $20,000. The unit selling price of X1 and X2 are $2.00 and $3.50, respectively. X1 60,000 units 100,000 units @ $2.00 $180,000 X2 40,000 units $20,000 @ $3.50 Determine the final unit cost of X1 and X2 when joint costs are allocated on the basis of net realizable value (NRV)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts