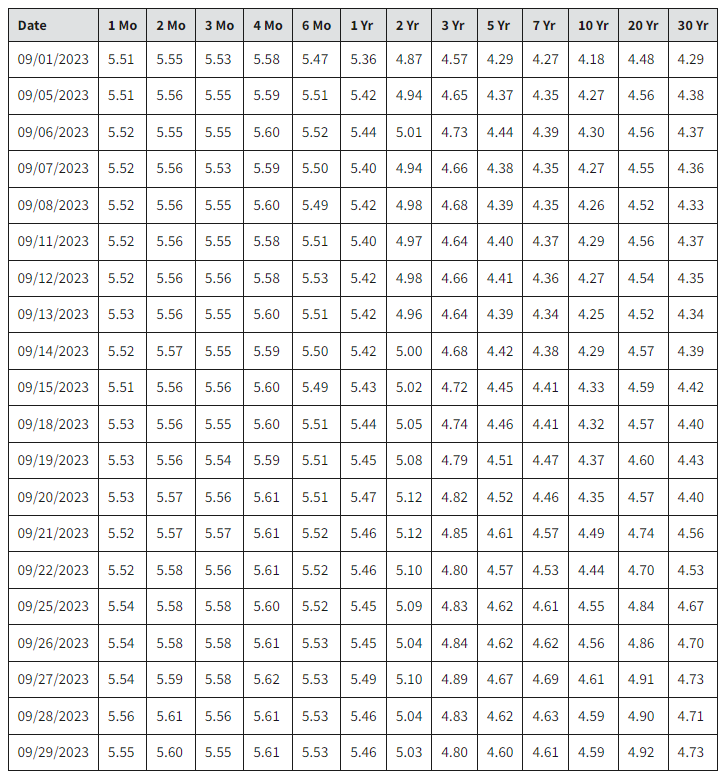

Question: How much should we pay for a 5 - year Treasury bond if we purchase it directly at the US treasury site at 4 .

How much should we pay for a year Treasury bond if we purchase it directly at the US treasury site at today? Assume that coupon payments are paid semiannually and we receive the face value of the bond of $ at maturity.

PV

If interest rates rise to what is the current value of the same bond now?

PV

Is this bond now trading at a premium, discount, or par value?

If I invest $ in a security that pays no dividends but pays interest annually, how much will this be worth in years?

FV

If I invest in the same security but it compounds monthly, how much will this be worth in years?

FV

If I invest in the same security but it compounds continuously, how much will this be worth in years?

EXP

If I know that the security matures at a value of $ then how do we solve for its present value?

Hint: Reverse the sign of the interest rate

EXP

If I have a series of irregular cash flows, which formula should I use?

What is the value the following set of irregular cash flows if I determine my opportunity cost to be

NPVSUMC:I

What if my opportunity cost is

NPVSUMC:I

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock