Question: How much will you save in 5 years for down payment and loan processing fee? Prepare a loan amortization schedule assuming loan tenure of 5

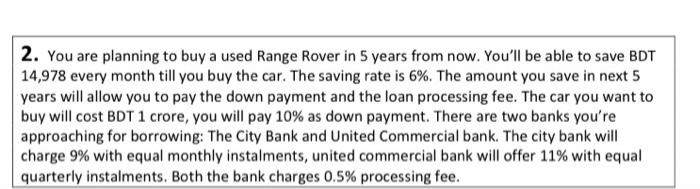

2. You are planning to buy a used Range Rover in 5 years from now. You'll be able to save BDT 14,978 every month till you buy the car. The saving rate is 6%. The amount you save in next 5 years will allow you to pay the down payment and the loan processing fee. The car you want to buy will cost BDT 1 crore, you will pay 10% as down payment. There are two banks you're approaching for borrowing: The City Bank and United Commercial bank. The city bank will charge 9% with equal monthly instalments, united commercial bank will offer 11% with equal quarterly instalments. Both the bank charges 0.5% processing fee. 2. You are planning to buy a used Range Rover in 5 years from now. You'll be able to save BDT 14,978 every month till you buy the car. The saving rate is 6%. The amount you save in next 5 years will allow you to pay the down payment and the loan processing fee. The car you want to buy will cost BDT 1 crore, you will pay 10% as down payment. There are two banks you're approaching for borrowing: The City Bank and United Commercial bank. The city bank will charge 9% with equal monthly instalments, united commercial bank will offer 11% with equal quarterly instalments. Both the bank charges 0.5% processing fee

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts