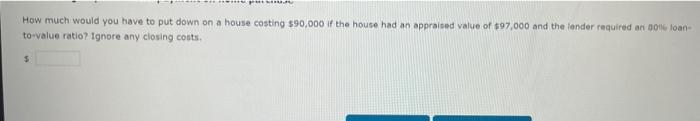

Question: . How much would you have to put down on a house costing $90,000 if the house had an appraised value of $97,000 and the

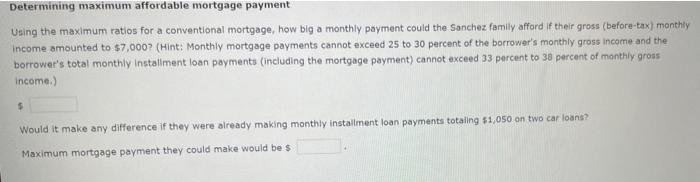

. How much would you have to put down on a house costing $90,000 if the house had an appraised value of $97,000 and the fender required an 3016 loan to-value ratio? Ignore any closing costs $ Determining maximum affordable mortgage payment Using the maximum ratios for a conventional mortgage, how big a monthly payment could the Sanchez family afford if their gross (before-tax) monthly Income amounted to $7,000? (Hint: Monthly mortgage payments cannot exceed 25 to 30 percent of the borrower's monthly gross income and the borrower's total monthly installment loan payments (including the mortgage payment) cannot exceed 33 percent to 38 percent of monthly gross income.) $ Would it make any difference if they were already making monthly installment loan payments totaling $1,050 on two car loans? Maximum mortgage payment they could make would be $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts