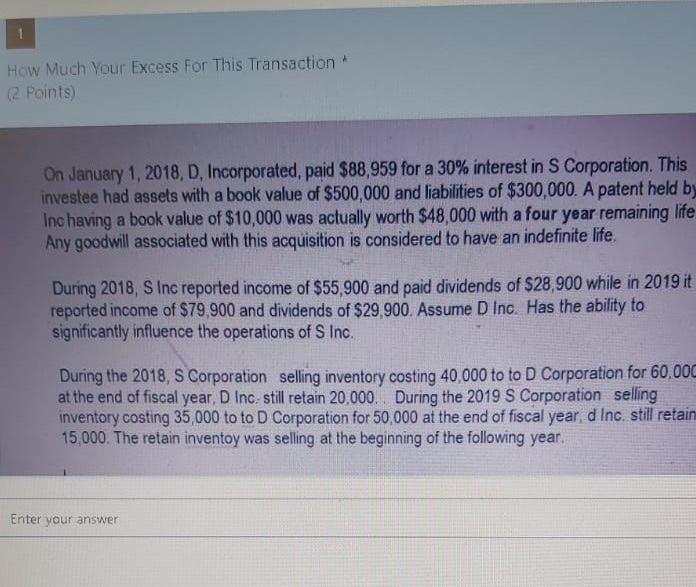

Question: How Much Your Excess For This Transaction (2 points) On January 1, 2018, D. Incorporated, paid $88,959 for a 30% interest in S Corporation. This

How Much Your Excess For This Transaction (2 points) On January 1, 2018, D. Incorporated, paid $88,959 for a 30% interest in S Corporation. This investee had assets with a book value of $500,000 and liabilities of $300,000. A patent held by Inc having a book value of $10,000 was actually worth $48,000 with a four year remaining life Any goodwill associated with this acquisition is considered to have an indefinite life During 2018, S Inc reported income of $55,900 and paid dividends of $28,900 while in 2019 it reported income of $79,900 and dividends of $29,900. Assume D Inc. Has the ability to significantly influence the operations of S Inc. During the 2018, S Corporation selling inventory costing 40,000 to to D Corporation for 60,000 at the end of fiscal year D Inc. still retain 20,000. During the 2019 S Corporation selling inventory costing 35,000 to to D Corporation for 50,000 at the end of fiscal year d Inc. still retain 15,000. The retain inventoy was selling at the beginning of the following year. Enter your answer How Much Your Excess For This Transaction (2 points) On January 1, 2018, D. Incorporated, paid $88,959 for a 30% interest in S Corporation. This investee had assets with a book value of $500,000 and liabilities of $300,000. A patent held by Inc having a book value of $10,000 was actually worth $48,000 with a four year remaining life Any goodwill associated with this acquisition is considered to have an indefinite life During 2018, S Inc reported income of $55,900 and paid dividends of $28,900 while in 2019 it reported income of $79,900 and dividends of $29,900. Assume D Inc. Has the ability to significantly influence the operations of S Inc. During the 2018, S Corporation selling inventory costing 40,000 to to D Corporation for 60,000 at the end of fiscal year D Inc. still retain 20,000. During the 2019 S Corporation selling inventory costing 35,000 to to D Corporation for 50,000 at the end of fiscal year d Inc. still retain 15,000. The retain inventoy was selling at the beginning of the following year. Enter your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts