Question: How to answer b) ? need explanation. A. Damaria Bhd. has the following details involving its inventories during the financial year end 31 December 2015

How to answer b) ? need explanation.

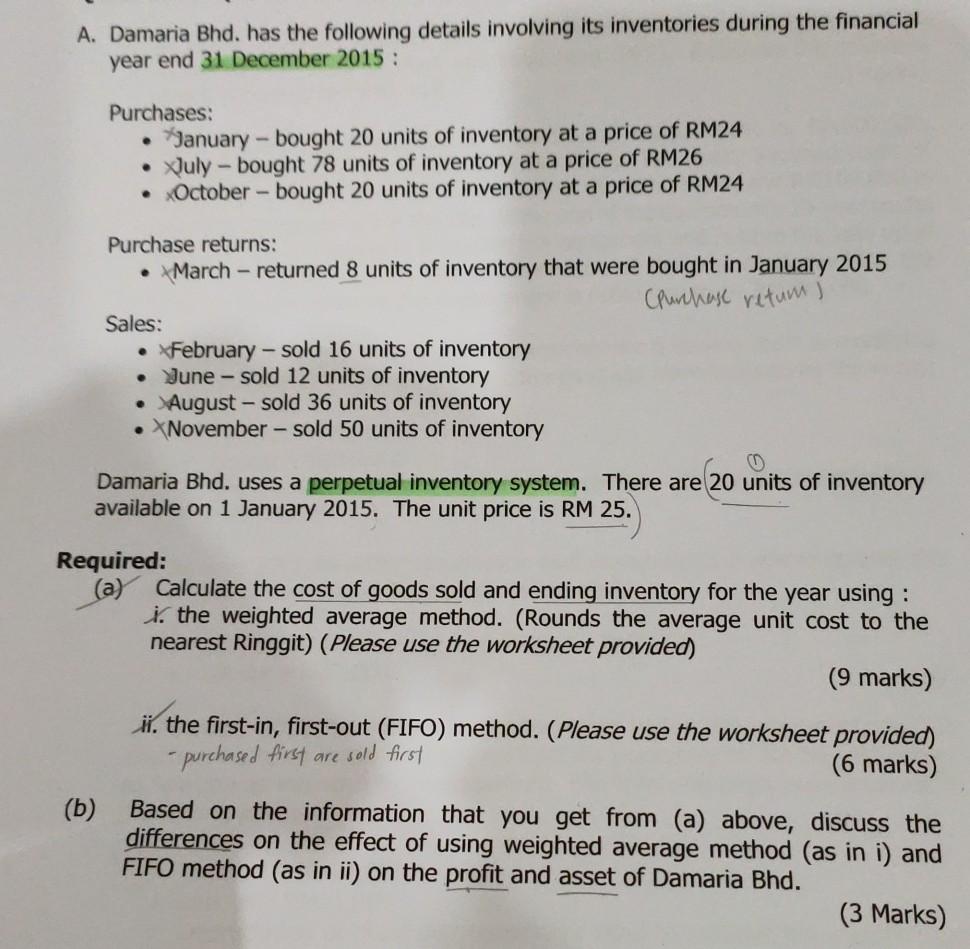

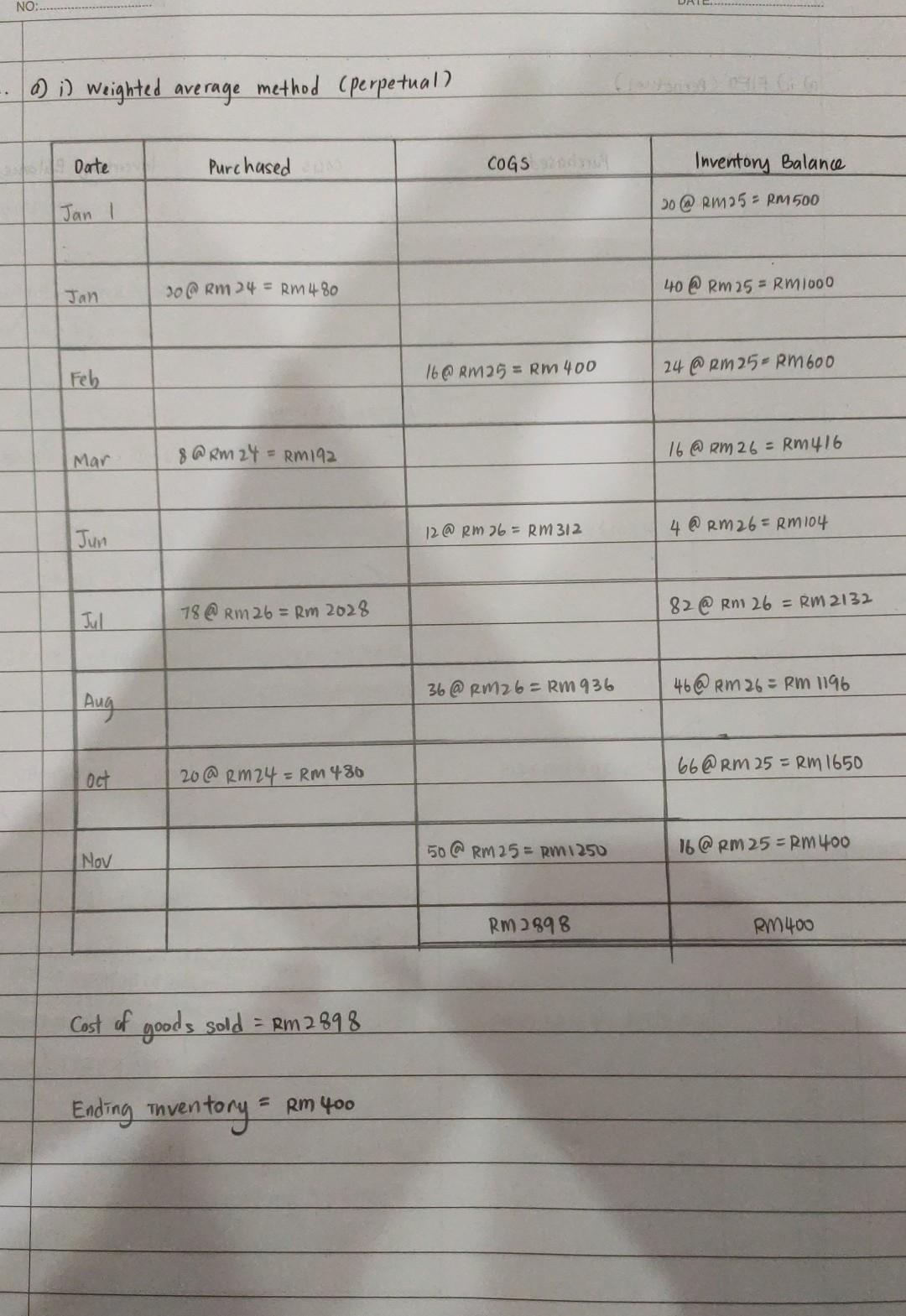

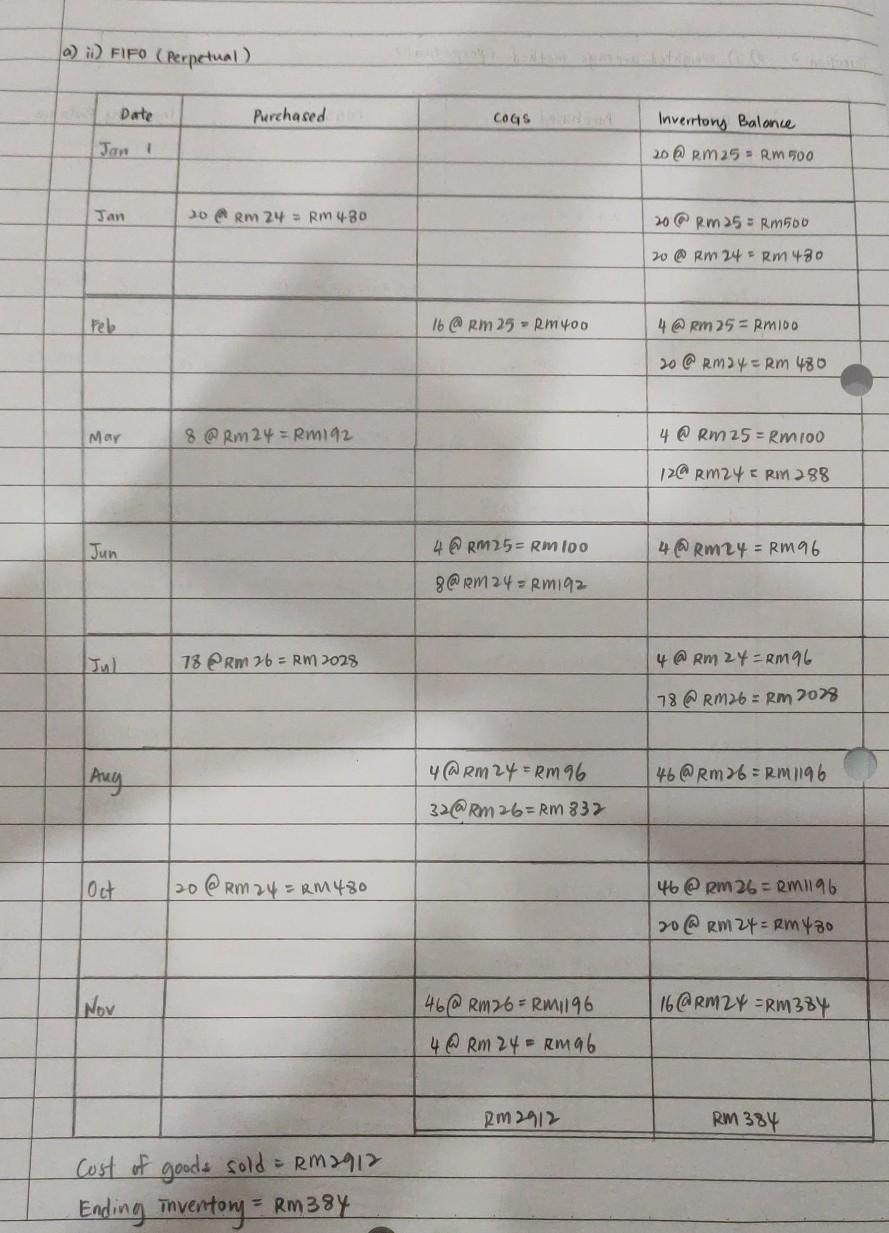

A. Damaria Bhd. has the following details involving its inventories during the financial year end 31 December 2015 : Purchases: January - bought 20 units of inventory at a price of RM24 Xuly - bought 78 units of inventory at a price of RM26 October - bought 20 units of inventory at a price of RM24 Purchase returns: March - returned 8 units of inventory that were bought in January 2015 (Purchase retum) Sales: February - sold 16 units of inventory June - sold 12 units of inventory August - sold 36 units of inventory . November - sold 50 units of inventory Damaria Bhd. uses a perpetual inventory system. There are 20 units of inventory available on 1 January 2015. The unit price is RM 25. Required: Calculate the cost of goods sold and ending inventory for the year using : i. the weighted average method. (Rounds the average unit cost to the nearest Ringgit) (Please use the worksheet provided) (9 marks) if the first-in, first-out (FIFO) method. (Please use the worksheet provided) purchased first are sold first (6 marks) (b) Based on the information that you get from (a) above, discuss the differences on the effect of using weighted average method (as in i) and FIFO method (as in ii) on the profit and asset of Damaria Bhd. (3 Marks) NO a) ;) Weighted average method (perpetual Darte Purchased COGS Inventory Balance Do @ RM25 - RM 500 Jan 1 Jan 30 RM24 = RM 480 40 @ Rm 25 = RM1000 Feb 16@ RM25 = RM 400 24 @ Rm 25= Rm600 Mar & @ RM 24 = Rm192 16 @ RM 26 = Rm 416 Jun 12 @ Rm 76 = RM 312 4 @ Rm 26=Rm104 Jul 78@ Rm 26 = Rm 2028 82 @ RM 26 = RM 2132 36@ RM26 = RM 936 46@RM 26= RM 1196 Aug 66@RM 25 = RM 1650 Oct 20@ RM24 = RM 430 50 @ RM 25 = Rm 1250 16 @ RM 25 = RM400 Nov Rm 2898 RM400 Cost of goods sold = Rm 2898 Ending inventory = Rm 400 a) D) FIFO (Perpetual Date Purchased COGS Invertory Balance 20 @ RM25 = RM 500 Jan 1 Jan 0 RM 24 = RM 480 20 RM25 = RM500 20 @ Rm 24 = Rm 480 Pele 16 @ Rm 25 = Rm4oo 4 @ RM 25 = RMIDD 20 @ Rm2y = Rm 480 Mar 8 @ Rm 24 = Rm192 4 @ Rm 25 = Rmioo @ RM24 RM 288 Jun 4 @ RM25 = Rmloo 4 @ Rm 24 = Rm96 8@ RM 24 = Rm192- 78 RM 2b = RM 2028 4 @ RM 24 = RM96 78 @ RM26 = Rm 7078 Aug 46@Rm76= RM 1196 4 @ RM 24 = Rm 96 32@RM 26=RM 837 (Oct 20 @ Rm 24 = R480 46 @ RM 26 = RM1196 20 @ RM2Y = Rm480 Nov 16 @ RM2Y =Rm384 46@ RM26 = RM1196 4 @ Rm 24 = Rmab Rm1 RM 384 = RM 2912 Cost of goods sold Ending inventory = Rm384

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts