Question: How to answer B, show solutions, please! thank you! Problem 11-5 Depreciation Methods Wendy's boss wants to use straight-line depreciation for the new expansion project

How to answer B, show solutions, please! thank you!

How to answer B, show solutions, please! thank you!

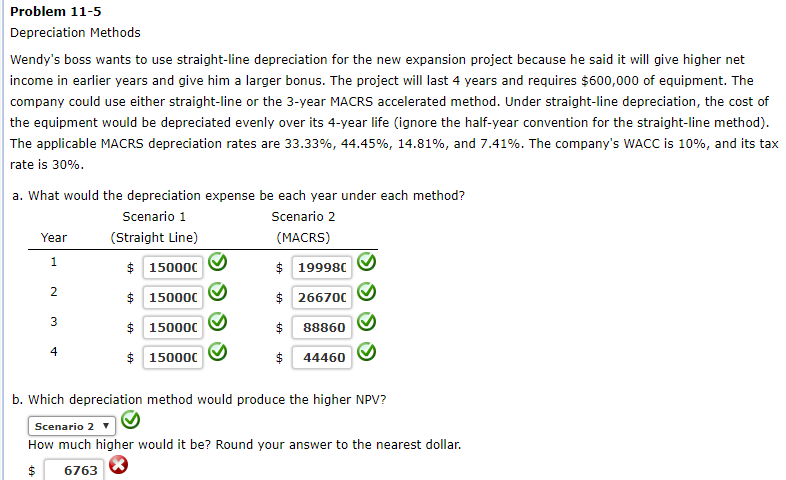

Problem 11-5 Depreciation Methods Wendy's boss wants to use straight-line depreciation for the new expansion project because he said it will give higher net income in earlier years and give him a larger bonus. The project will last 4 years and requires $600,000 of equipment. The company could use either straight-line or the 3-year MACRS accelerated method. Under straight-line depreciation, the cost of the equipment would be depreciated evenly over its 4-year life (ignore the half-year convention for the straight-line method) The applicable MACRS depreciation rates are 33.33%, 44.45%, 14.81%, and 7.41%. The company's WACC is 10%, and its tax rate is 30% a. What would the depreciation expense be each year under each method? Scenario 1 Scenario 2 (MACRS) $199980 $266700 $88860 $44460 Year (Straight Line) $150000 $150000 $150000 $150000 2 4 b. Which depreciation method would produce the higher NPV? Scenario 2 How much higher would it be? Round your answer to the nearest dollar. $6763

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts