Question: how to answer part (b) 6. The following table provides information on three portfolios available in the market: Portfolio Sensitivity to factor 1 Sensitivity to

how to answer part (b)

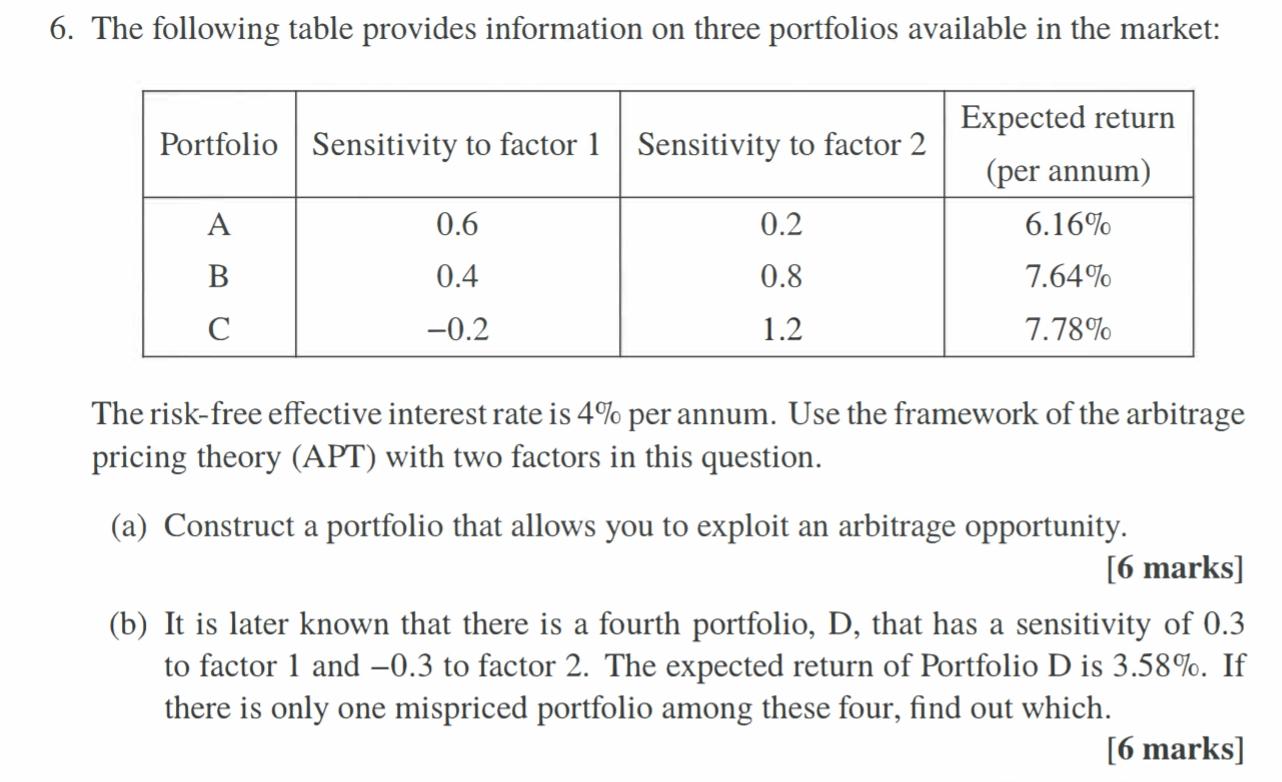

6. The following table provides information on three portfolios available in the market: Portfolio Sensitivity to factor 1 Sensitivity to factor 2 Expected return (per annum) 6.16% 7.64% A 0.6 0.2 0.8 B 0.4 -0.2 1.2 7.78% The risk-free effective interest rate is 4% per annum. Use the framework of the arbitrage pricing theory (APT) with two factors in this question. (a) Construct a portfolio that allows you to exploit an arbitrage opportunity. [6 marks] (b) It is later known that there is a fourth portfolio, D, that has a sensitivity of 0.3 to factor 1 and -0.3 to factor 2. The expected return of Portfolio D is 3.58%. If there is only one mispriced portfolio among these four, find out which. [6 marks] 6. The following table provides information on three portfolios available in the market: Portfolio Sensitivity to factor 1 Sensitivity to factor 2 Expected return (per annum) 6.16% 7.64% A 0.6 0.2 0.8 B 0.4 -0.2 1.2 7.78% The risk-free effective interest rate is 4% per annum. Use the framework of the arbitrage pricing theory (APT) with two factors in this question. (a) Construct a portfolio that allows you to exploit an arbitrage opportunity. [6 marks] (b) It is later known that there is a fourth portfolio, D, that has a sensitivity of 0.3 to factor 1 and -0.3 to factor 2. The expected return of Portfolio D is 3.58%. If there is only one mispriced portfolio among these four, find out which. [6 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts