Question: How to answer question (e) PART III: POLICY ANALYSIS 1. Suppose market demand for oranges is given by QD = 500 10P where Q D

How to answer question (e)

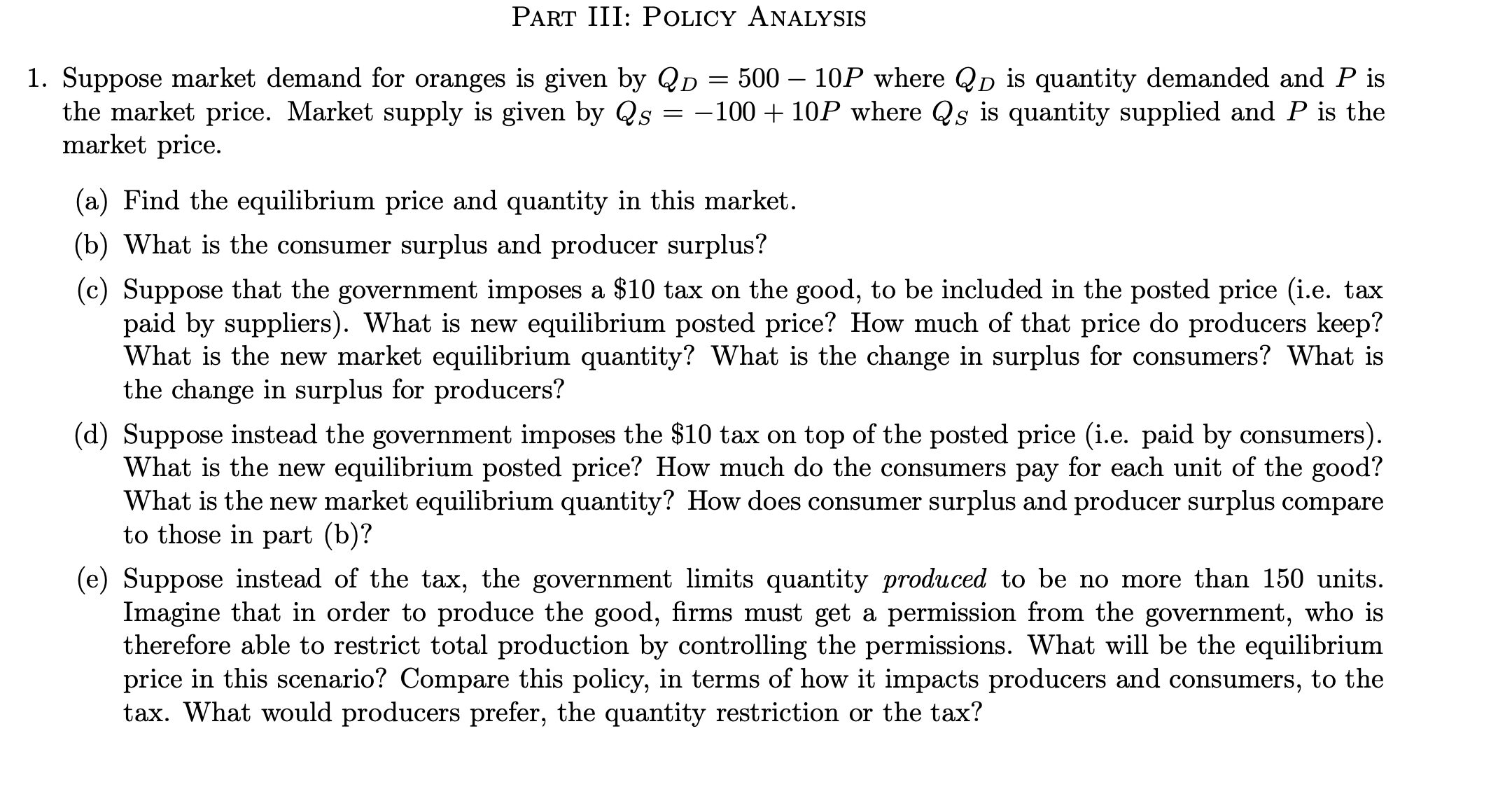

PART III: POLICY ANALYSIS 1. Suppose market demand for oranges is given by QD = 500 10P where Q D is quantity demanded and P is the market price. Market supply is given by Q; = 100 + 10P where Q5 is quantity supplied and P is the market price. (a) Find the equilibrium price and quantity in this market. (b) What is the consumer surplus and producer surplus? (c) Suppose that the government imposes a $10 tax on the good, to be included in the posted price (i.e. tax paid by suppliers). What is new equilibrium posted price? How much of that price do producers keep? What is the new market equilibrium quantity? What is the change in surplus for consumers? What is the change in surplus for producers? ((1) Suppose instead the government imposes the $10 tax on top of the posted price (i.e. paid by consumers). What is the new equilibrium posted price? How much do the consumers pay for each unit of the good? What is the new market equilibrium quantity? How does consumer surplus and producer surplus compare to those in part (b)? (e) Suppose instead of the tax, the government limits quantity produced to be no more than 150 units. Imagine that in order to produce the good, rms must get a permission from the government, who is therefore able to restrict total production by controlling the permissions. What will be the equilibrium price in this scenario? Compare this policy, in terms of how it impacts producers and consumers, to the tax. What would producers prefer, the quantity restriction or the tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts