Question: How to answer these question :( 2. Amber Plc is expected to pay a dividend of 12 pence per share next year. Dividends are expected

How to answer these question :(

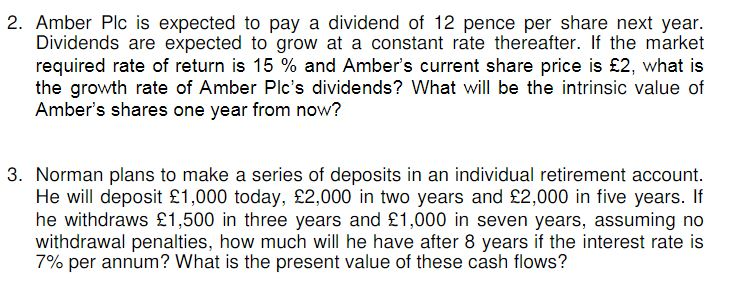

2. Amber Plc is expected to pay a dividend of 12 pence per share next year. Dividends are expected to grow at a constant rate thereafter. If the market required rate of return is 15 % and Amber's current share price is 2, what is the growth rate of Amber Plc's dividends? What will be the intrinsic value of Amber's shares one year from now? 3. Norman plans to make a series of deposits in an individual retirement account. He will deposit 1,000 today, 2,000 in two years and 2,000 in five years. If he withdraws 1,500 in three years and 1,000 in seven years, assuming no withdrawal penalties, how much will he have after 8 years if the interest rate is 7% per annum? What is the present value of these cash flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts