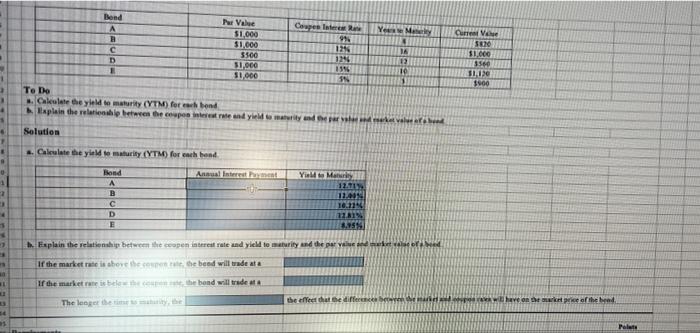

Question: how to calculate annual interest payment? please explain section b as well Bend Coupe Interest 98 125 . . P Valve $1,000 31,000 5500 1.000

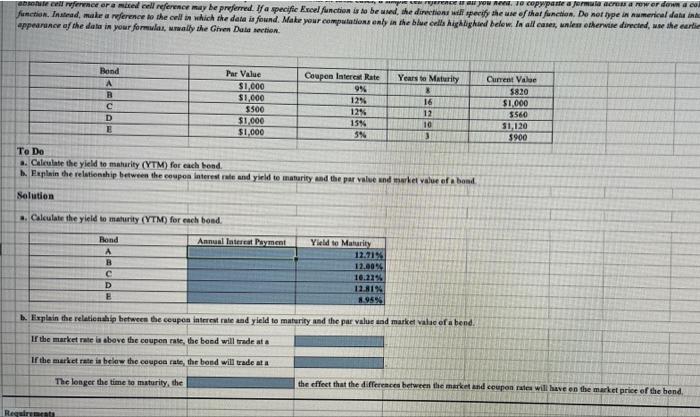

Bend Coupe Interest 98 125 . . P Valve $1,000 31,000 5500 1.000 31000 C D E Ye M 4 NA 12 10 1 Curreal Ve 50 $1.000 3560 11.130 1900 1996 SN 1 . To Do Calele deyild tematy CYTM) for each bend Raplain the relationship between the cowpos interest wie and Moderne ville . Solution .. Calelate the yield te maturity (YTM) for each bond An Internet Yo Mar 1 Bond A B C 10.21% D E . Explain the relationship between the open interest rate and yield terity and the per If the market rate is where there the bed will trade ata If the market is the the band will trade The longer bei the effect at the difference have on the price of the brad Plate w Yow we coppested or acron a rower down a cum boc rerne er med cell reference may be preferred. 1/a specific Excel function to be wd, the direction will perishe use of that function. Do not hype in numerical dat ik function. Instead, make a merence to the call on which the data is found. Make your computations only in the blue cells highlighand below. In all cut, unless otherwise directed, we the cantie appearance of the data is your formula, wally the Glen Duta section. Bond A B D E Par Value $1,000 $1,000 5500 $1.000 $1,000 Coupon Interest Rate 9% 12% 12% 15% 5% Years to Maturity 3 16 12 10 3 Current Value 5820 SI 000 5560 31.120 5900 To Do .. Caleulate the yield to maharity (YTM) for each hond . Explain the relationship between the coupon Interest rate and yield te maturity and the par value and market value of a banil Solution .. Calculate the yield to maturity (YTM) for each bond. Rond Annual Interest Payment A B D E Yield to Maturity 12.71% 12.00% 10.21% 12.81% 8.95% 1. Explain the relationship between the coupon interest rate and yield te maturity and the par value and market value of a bend If the market rate la above the coupon rate, the band will trade ata Ir the market rate is below the coupon rate, the bond will trade at The longer the time to maturity, the the effect that the differences between the market and coupon rates will have en the market price of the hend Requirement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts