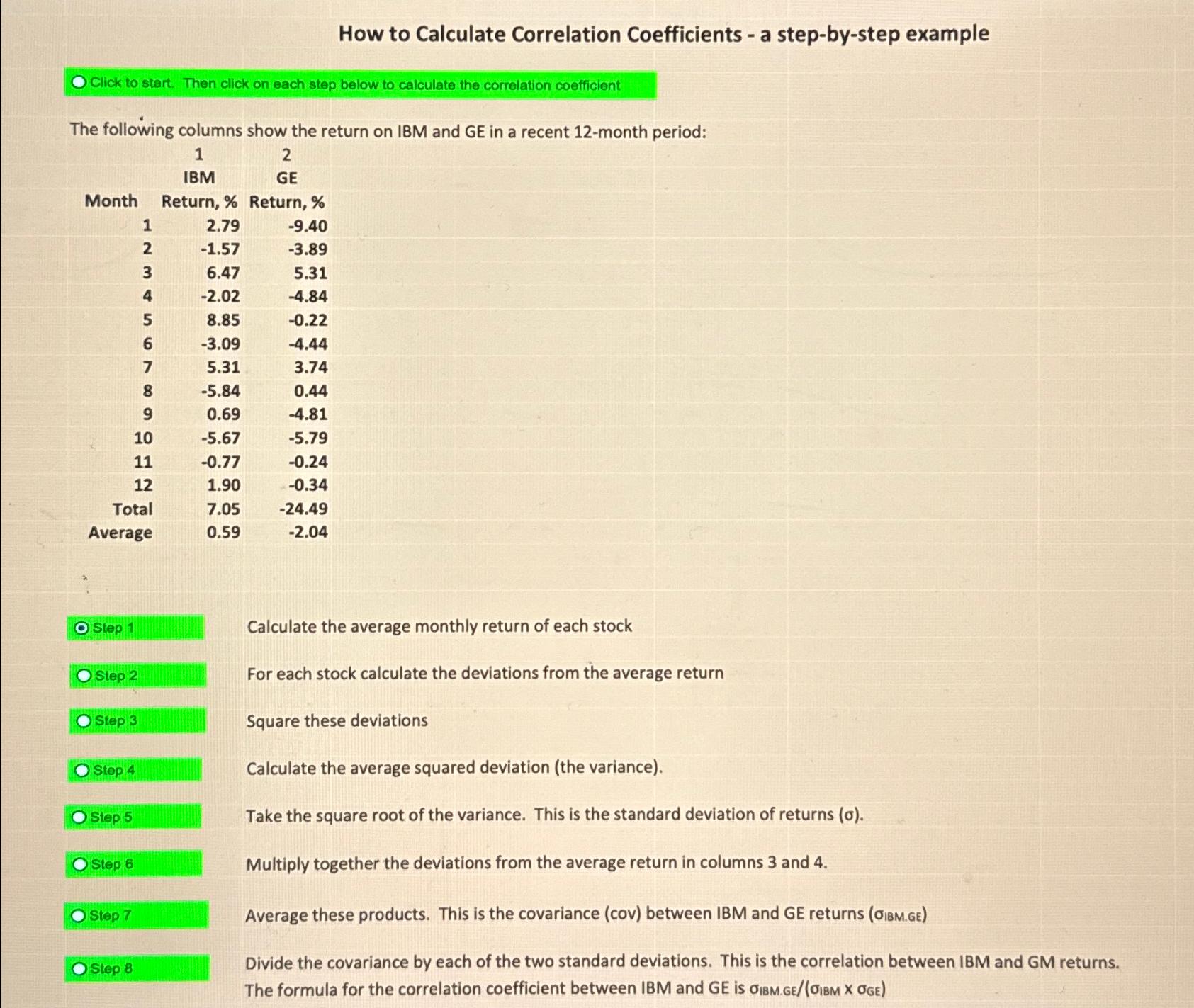

Question: How to Calculate Correlation Coefficients - a step-by-step example O Click to start. Then click on each step below to calculate the correlation coefficient

How to Calculate Correlation Coefficients - a step-by-step example O Click to start. Then click on each step below to calculate the correlation coefficient The following columns show the return on IBM and GE in a recent 12-month period: 1 IBM 2 GE Return, % Return, % Month 1 2.79 -9.40 2 -1.57 -3.89 3 6.47 5.31 4 -2.02 -4.84 5 8.85 -0.22 6 -3.09 -4.44 7 5.31 3.74 8 -5.84 0.44 9 0.69 -4.81 10 -5.67 -5.79 11 -0.77 -0.24 12 1.90 -0.34 Total 7.05 -24.49 Average 0.59 -2.04 O Step 1 Step 2 Step 3 O Step 4 Calculate the average monthly return of each stock For each stock calculate the deviations from the average return Square these deviations Calculate the average squared deviation (the variance). Take the square root of the variance. This is the standard deviation of returns (o). Step 5 Step 6 Multiply together the deviations from the average return in columns 3 and 4. Step 7 Average these products. This is the covariance (cov) between IBM and GE returns (OIBM.GE) Step 8 Divide the covariance by each of the two standard deviations. This is the correlation between IBM and GM returns. The formula for the correlation coefficient between IBM and GE is OIBM.GE/(OIBM X OGE)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts