Question: how to calculate for each & apply hint 55 - 58 instructions to panel B D The James Island Cothing Company began operations on July

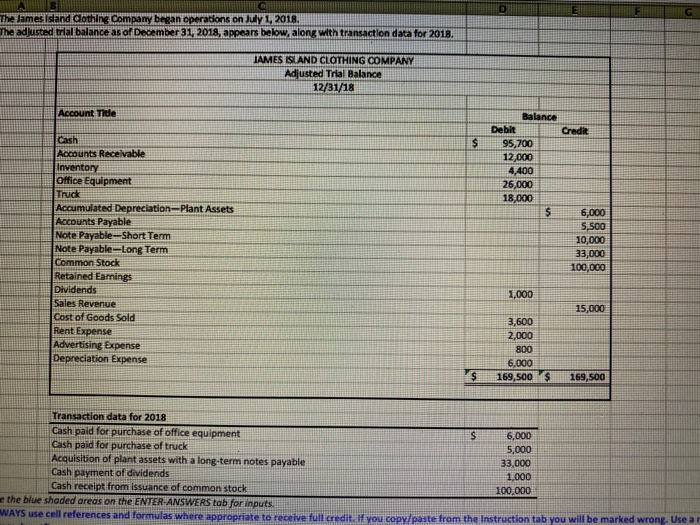

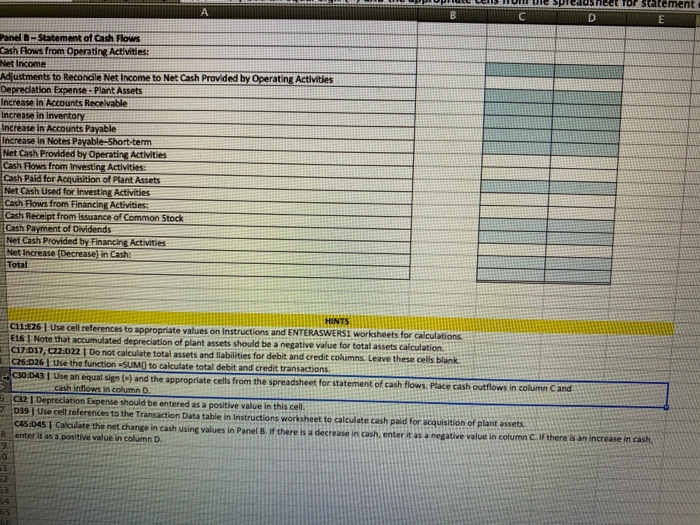

D The James Island Cothing Company began operations on July 1, 2018. The adjusted trial balance as of December 31, 2018, appears below, along with transaction data for 2018. IAMES ISLAND CLOTHING COMPANY Adjusted Trial Balance 12/31/18 Account Title Credit $ Balance Debit 95,700 12.000 4,400 26,000 18,000 $ Cash Accounts Receivable Inventory Office Equipment Truck Accumulated Depreciation-Plant Assets Accounts Payable Note Payable-Short Term Note Payable=Long Term Common Stock Retained Earnings Dividends Sales Revenue Cost of Goods Sold Rent Expense Advertising Expense Depreciation Expense 6,000 5,500 10,000 33,000 100,000 1,000 15,000 3,600 2,000 800 6,000 169,500 $ $ 169,500 Transaction data for 2018 Cash paid for purchase of office equipment S 6,000 Cash paid for purchase of truck 5,000 Acquisition of plant assets with a long-term notes payable 33,000 Cash payment of dividends 1,000 Cash receipt from issuance of common stock 100.000 e the blue shaded areas on the ENTER-ANSWERS tab for inputs. WAYS use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instruction tab you will be marked wrong. Use ar USASPU A B C Tor statement E D Panel B-Statement of Cash Flows Cash Flows from Operating Activities: Net Income Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities Depreciation Expense - Plant Assets Increase in Accounts Receivable Increase in Inventory Increase in Accounts Payable Increase in Notes Payable-Short-term Net Cash Provided by Operating Activities Cash Flows from Investing Activities: Cash Paid for Acquisition of Plant Assets Net Cash Used for Investing Activities Cash Flows from Financing Activities: Cash Receipt from Issuance of Common Stock Cash Payment of Dividends Net Cash Provided by Financing Activities Net Increase (Decrease) in Cash: Total HINTS C11:26 Use cell references to appropriate values on Instructions and ENTERASWERSI worksheets for calculations E16 Note that accumulated depreciation of plant assets should be a negative value for total assets calculation 17:017, 022:022 Do not calculate total assets and liabilities for debit and credit columns. Leave these cells blank C26:026 Use the function=SUMO to calculate total debit and credit transactions. C30.043 | Use an equal sign (w) and the appropriate cells from the spreadsheet for statement of cash flows. Place cash outflows in column C and cash inflows in column D. 32 Depreciation Expense should be entered as a positive value in this cell 039 Use cell references to the Transaction Data table in Instructions worksheet to calculate cash paid for acquisition of plant assets. C45:045 | Calculate the net change in cash using values in Panel B. If there is a decrease in cash, enter it as a negative value in column C there is an increase in cash 8 enter it as a positive value in column D. 9 -0 1 52 53 55 5 D The James Island Cothing Company began operations on July 1, 2018. The adjusted trial balance as of December 31, 2018, appears below, along with transaction data for 2018. IAMES ISLAND CLOTHING COMPANY Adjusted Trial Balance 12/31/18 Account Title Credit $ Balance Debit 95,700 12.000 4,400 26,000 18,000 $ Cash Accounts Receivable Inventory Office Equipment Truck Accumulated Depreciation-Plant Assets Accounts Payable Note Payable-Short Term Note Payable=Long Term Common Stock Retained Earnings Dividends Sales Revenue Cost of Goods Sold Rent Expense Advertising Expense Depreciation Expense 6,000 5,500 10,000 33,000 100,000 1,000 15,000 3,600 2,000 800 6,000 169,500 $ $ 169,500 Transaction data for 2018 Cash paid for purchase of office equipment S 6,000 Cash paid for purchase of truck 5,000 Acquisition of plant assets with a long-term notes payable 33,000 Cash payment of dividends 1,000 Cash receipt from issuance of common stock 100.000 e the blue shaded areas on the ENTER-ANSWERS tab for inputs. WAYS use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instruction tab you will be marked wrong. Use ar USASPU A B C Tor statement E D Panel B-Statement of Cash Flows Cash Flows from Operating Activities: Net Income Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities Depreciation Expense - Plant Assets Increase in Accounts Receivable Increase in Inventory Increase in Accounts Payable Increase in Notes Payable-Short-term Net Cash Provided by Operating Activities Cash Flows from Investing Activities: Cash Paid for Acquisition of Plant Assets Net Cash Used for Investing Activities Cash Flows from Financing Activities: Cash Receipt from Issuance of Common Stock Cash Payment of Dividends Net Cash Provided by Financing Activities Net Increase (Decrease) in Cash: Total HINTS C11:26 Use cell references to appropriate values on Instructions and ENTERASWERSI worksheets for calculations E16 Note that accumulated depreciation of plant assets should be a negative value for total assets calculation 17:017, 022:022 Do not calculate total assets and liabilities for debit and credit columns. Leave these cells blank C26:026 Use the function=SUMO to calculate total debit and credit transactions. C30.043 | Use an equal sign (w) and the appropriate cells from the spreadsheet for statement of cash flows. Place cash outflows in column C and cash inflows in column D. 32 Depreciation Expense should be entered as a positive value in this cell 039 Use cell references to the Transaction Data table in Instructions worksheet to calculate cash paid for acquisition of plant assets. C45:045 | Calculate the net change in cash using values in Panel B. If there is a decrease in cash, enter it as a negative value in column C there is an increase in cash 8 enter it as a positive value in column D. 9 -0 1 52 53 55 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts