Question: How to calculate NPV? You are considering constructing a new plant to manufacture a new product. You anticipate that the plant will take a year

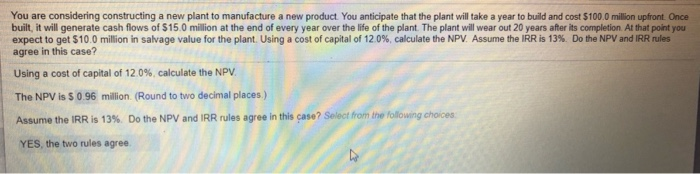

You are considering constructing a new plant to manufacture a new product. You anticipate that the plant will take a year to build and cost $100.0 million upfront. Once built, it will generate cash flows of $15.0 million at the end of every year over the life of the plant. The plant will wear out 20 years after its completion At that point you expect to get 510.0 million in salvage value for the plant. Using a cost of capital of 12.0%, calculate the NPV. Assume the IRR is 13%. Do the NPV and IRR rules agree in this case? Using a cost of capital of 12.0%, calculate the NPV. The NPV is $ 0.96 million (Round to two decimal places) Assume the IRR is 13%. Do the NPV and IRR rules agree in this case? Select from the following choices YES, the two rules agree

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts