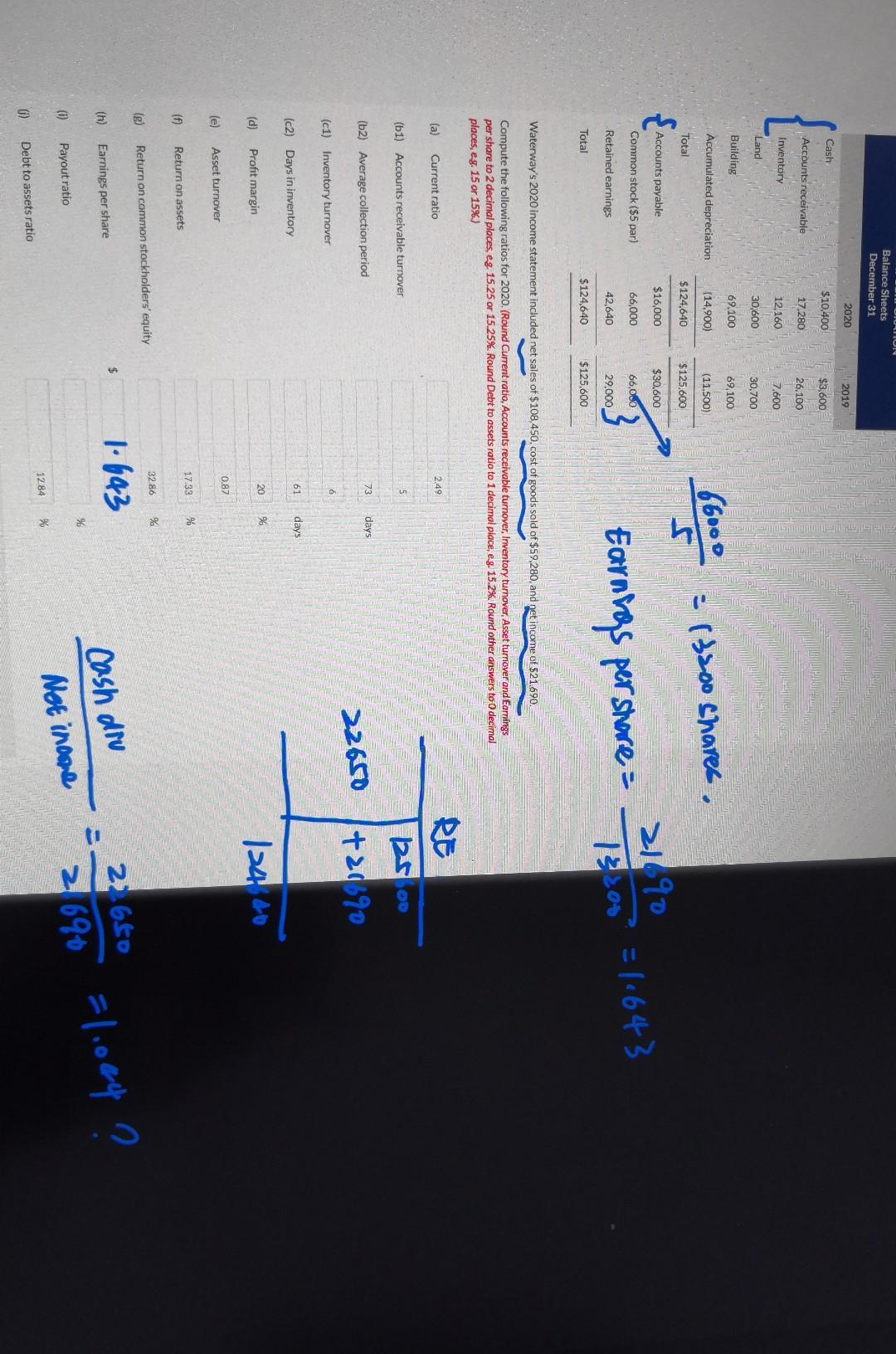

Question: How to calculate payout ratio in this question Do we need to use retained earning in the balance sheet to calculate the cash dividends paid?

How to calculate payout ratio in this question

Do we need to use retained earning in the balance sheet to calculate the cash dividends paid?

T (d) (e) Cash (f) (1) (i) Accounts receivable (g) Inventory (h) (a) Current ratio Land Building Accumulated depreciation Total Accounts payable Common stock ($5 par) Retained earnings Total (c1) Inventory turnover (c2) Days in inventory (b2) Average collection period (b1) Accounts receivable turnover Profit margin Asset turnover Balance Sheets December 31 Return on assets Waterway's 2020 income statement included net sales of $108,450, cost of goods sold of $59,280, and net income of $21,690. Compute the following ratios for 2020. (Round Current ratio, Accounts receivable turnover, Inventory turnover, Asset turnover and Earnings per share to 2 decimal places, eg 15.25 or 15.25%. Round Debt to assets ratio to 1 decimal place, e.g. 15.2%. Round other answers to 0 decimal places, e.g. 15 or 15%) Earnings per share Payout ratio 2020 $10,400 17,280 12,160 Debt to assets ratio 30,600 69,100 (14,900) $124,640 $16,000 66,000 42,640 $124,640 Return on common stockholders' equity 2019 $3,600 26,100 7,600 30,700 69,100 (11,500) $125.600 $30,600 66.000 29,000 $125,600 66000 2.49 5 73 6 61 20 0.87 17.33 32.86 1.643 12.84 days days % % % Earnings per share= % = 13200 shares, % 22650 Cash div Net inome 21690 13208=11643 RE 125.00 +2690 124640 = 22650 21690 = 1.004

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts