Question: How to calculate the second question and third question? Use the following information to answer the three questions below: A firm has an opportunity cost

How to calculate the second question and third question?

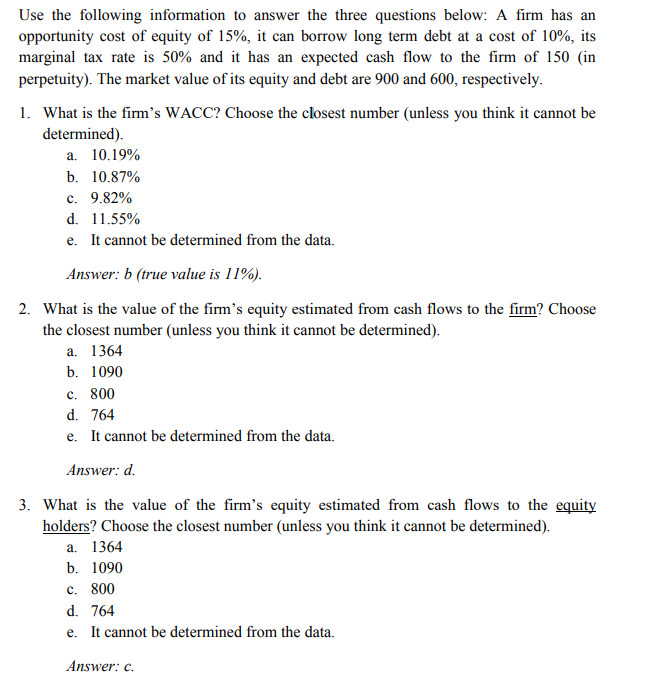

Use the following information to answer the three questions below: A firm has an opportunity cost of equity of 15%, it can borrow long term debt at a cost of 10%, its marginal tax rate is 50% and it has an expected cash flow to the firm of 150 (in perpetuity). The market value of its equity and debt are 900 and 600, respectively 1. What is the firm's WACC? Choose the closest number (unless you think it cannot be determined) a. 10.19% 10.87% 9.82% 11.55% It cannot be determined from the data. b. . d. e. Answer: b (true value is 1 196) 2. What is the value of the firm's equity estimated from cash flows to the firm? Choose the closest number (unless you think it cannot be determined) a. 1364 b. 1090 . 800 d. 764 e. It cannot be determined from the data. Answer: d 3. What is the value of the firm's equity estimated from cash flows to the equity holders? Choose the closest number (unless you think it cannot be determined) a. 1364 b. 1090 c. 800 d. 764 e. It cannot be determined from the data. Answer: c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts