Question: how to calculate the yield without face value in excel? Or in anyways? The spreadsheet provided shows a list of bonds issued by the Australian

how to calculate the yield without face value in excel? Or in anyways?

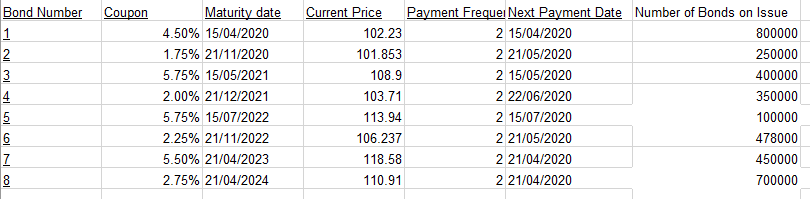

The spreadsheet provided shows a list of bonds issued by the Australian government and their relevant characteristics as of the 27th of March 2020. Based on the information provided, complete the following calculations in excel. A. Calculate the yield of each bond as of the 28th of March. (5 Marks) Bond Number Coupon Im L Maturity date 4.50% 15/04/2020 1.75% 21/11/2020 5.75% 15/05/2021 2.00% 21/12/2021 5.75% 15/07/2022 2.25% 21/11/2022 5.50% 21/04/2023 2.75% 21/04/2024 Current Price Payment Frequer Next Payment Date Number of Bonds on Issue 102.23 2 15/04/2020 800000 101.853 2 21/05/2020 250000 108.9 2 15/05/2020 400000 103.71 2 22/06/2020 350000 113.94 2 15/07/2020 100000 106.237 2 21/05/2020 478000 118.58 2 21/04/2020 450000 110.91 2 21/04/2020 700000 N001 The spreadsheet provided shows a list of bonds issued by the Australian government and their relevant characteristics as of the 27th of March 2020. Based on the information provided, complete the following calculations in excel. A. Calculate the yield of each bond as of the 28th of March. (5 Marks) Bond Number Coupon Im L Maturity date 4.50% 15/04/2020 1.75% 21/11/2020 5.75% 15/05/2021 2.00% 21/12/2021 5.75% 15/07/2022 2.25% 21/11/2022 5.50% 21/04/2023 2.75% 21/04/2024 Current Price Payment Frequer Next Payment Date Number of Bonds on Issue 102.23 2 15/04/2020 800000 101.853 2 21/05/2020 250000 108.9 2 15/05/2020 400000 103.71 2 22/06/2020 350000 113.94 2 15/07/2020 100000 106.237 2 21/05/2020 478000 118.58 2 21/04/2020 450000 110.91 2 21/04/2020 700000 N001

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts