Question: how to calculate y? can you do it step by step? given that B = 98.598, why is y 6.8% Zero-coupon Rates Example: Bond: FV=100,T=2,CS/A=6%,

how to calculate y? can you do it step by step? given that B = 98.598, why is "y" 6.8%

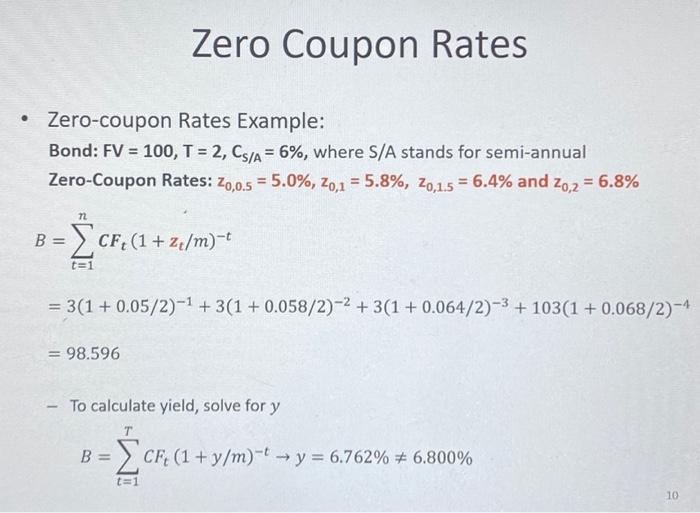

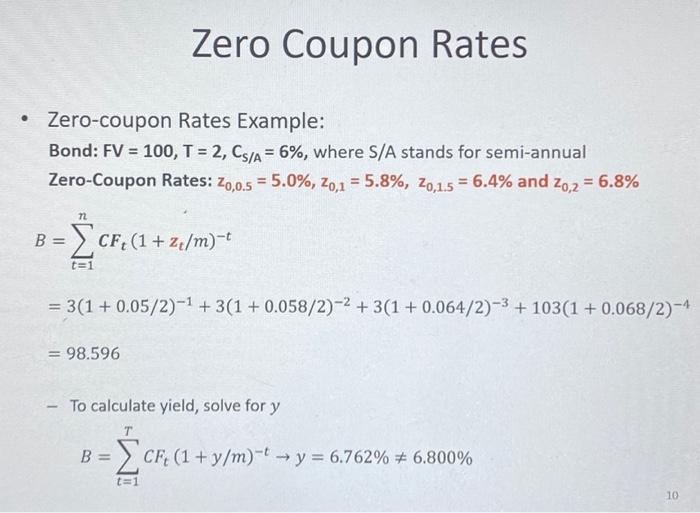

Zero-coupon Rates Example: Bond: FV=100,T=2,CS/A=6%, where S/A stands for semi-annual Zero-Coupon Rates: z0,0.5=5.0%,z0,1=5.8%,z0,1.5=6.4% and z0,2=6.8% B=t=1nCFt(1+zt/m)t=3(1+0.05/2)1+3(1+0.058/2)2+3(1+0.064/2)3+103(1+0.068/2)=98.596 - To calculate yield, solve for y B=t=1TCFt(1+y/m)ty=6.762%=6.800%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock