Question: how to create a template for this in Excel? having problems with the formulas The time value of money refers to the changes in the

how to create a template for this in Excel? having problems with the formulas

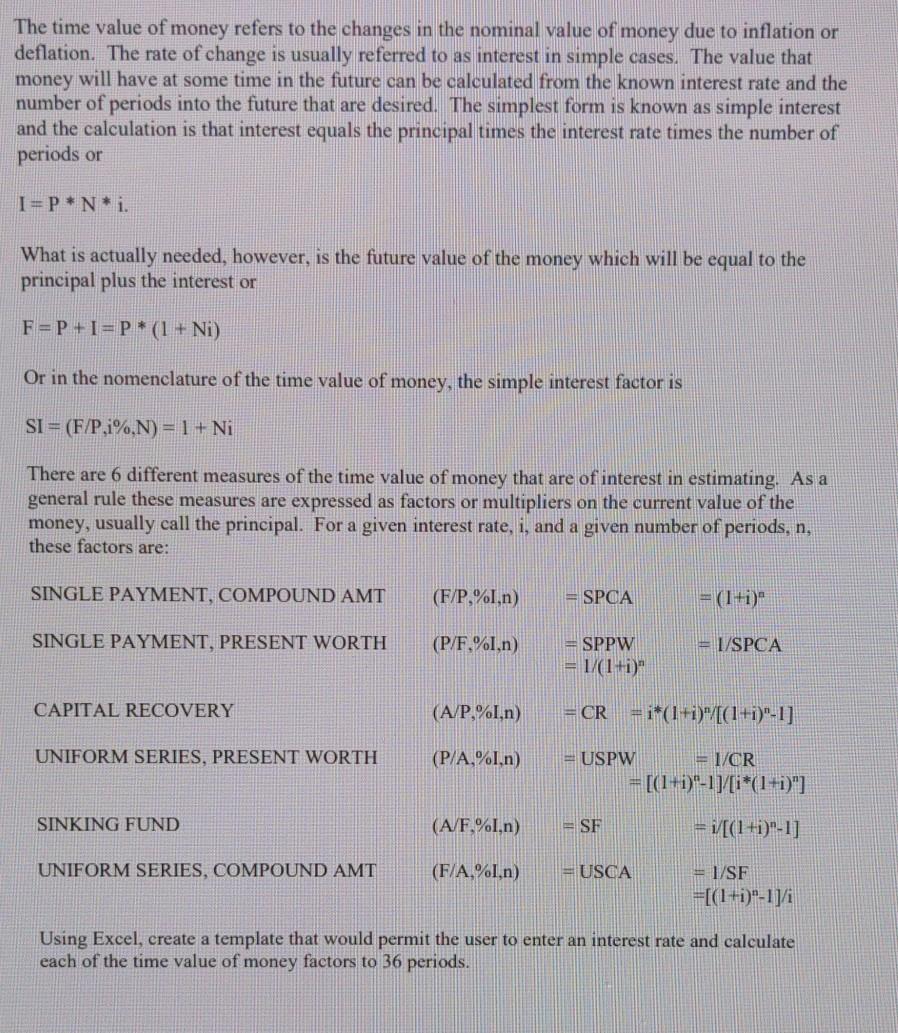

The time value of money refers to the changes in the nominal value of money due to inflation or deflation. The rate of change is usually referred to as interest in simple cases. The value that money will have at some time in the future can be calculated from the known interest rate and the number of periods into the future that are desired. The simplest form is known as simple interest and the calculation is that interest equals the principal times the interest rate times the number of periods or I=P*Ni. What is actually needed, however, is the future value of the money which will be equal to the principal plus the interest or F = P +I=P* (1 + Ni) Or in the nomenclature of the time value of money, the simple interest factor is SI = (F/P,i%N) = 1 + Ni There are 6 different measures of the time value of money that are of interest in estimating. As a general rule these measures are expressed as factors or multipliers on the current value of the money, usually call the principal. For a given interest rate, i, and a given number of periods, n, these factors are: SINGLE PAYMENT, COMPOUND AMT (F/P, %In SPCA = (Iti)" SINGLE PAYMENT, PRESENT WORTH (P/F.%.n) = 1/SPCA SPPW = 1/(1+i)" CAPITAL RECOVERY (A/P%.n) = CR = i*(1+i)"/((1+i)"-1] UNIFORM SERIES, PRESENT WORTH (P/A,%I,n) = USPW EI/CR = [(1-1)-1][i*(1+i)"] SINKING FUND (A/F.%I,n) = SF - i/[(1 +i)"-1] UNIFORM SERIES, COMPOUND AMT (F/A %1,n) = USCA = 1/SE =[(1+i)"-1]/ Using Excel, create a template that would permit the user to enter an interest rate and calculate each of the time value of money factors to 36 periods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts