Question: How to do B2,B3 and C2? Check my work 5 Refer to the stock options on Microsoft in the Figure 2.10. Suppose you buy a

How to do B2,B3 and C2?

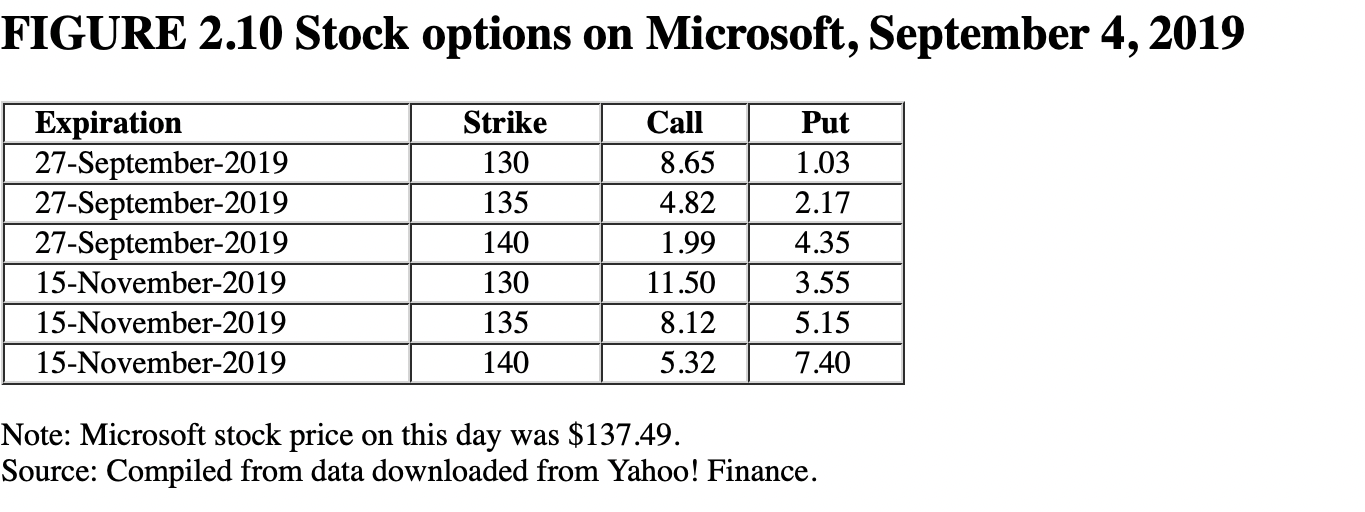

Check my work 5 Refer to the stock options on Microsoft in the Figure 2.10. Suppose you buy a November expiration call option on 200 shares with the excise price of $135. a-1. If the stock price in November is $142, will you exercise your call? 16.66 points Yes No Book Print a-2. What is the net profit/loss on your position? (Input the amount as a positive value.) Net profit of $ 224 References a-3. What is the rate of return on your position? (Negative value should be indicated by a minus sign. Round your answer to 2 decimal places.) Rate of return 13.79% b-1. Would you exercise the call if you had bought the November call with the exercise price $130? O Yes b-2. What is the net profit/loss on your position? (Input the amount as a positive value.) Net profit of $ 624 b-3. What is the rate of return on your position? (Negative value should be indicated by a minus sign. Round your answer to 2 decimal places.) Rate of return 38.42% C-1. What if you had bought an November put with exercise price $135 instead? Would you exercise the put at a stock price of $135? Yes No C-2. What is the rate of return on your position? (Negative value should be indicated by a minus sign.) Rate of return 100% FIGURE 2.10 Stock options on Microsoft, September 4, 2019 Expiration 27-September-2019 27-September-2019 27-September-2019 15-November-2019 15-November-2019 15-November-2019 Strike 130 135 140 130 135 140 Call 8.65 4.82 1.99 11.50 8.12 5.32 Put 1.03 2.17 4.35 3.55 5.15 7.40 Note: Microsoft stock price on this day was $137.49. Source: Compiled from data downloaded from Yahoo! Finance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts