Question: how to do case 11 and 12? Case/Exercise 10 John has a credit card with a billing period that goes from the 16th of a

how to do case 11 and 12?

how to do case 11 and 12?

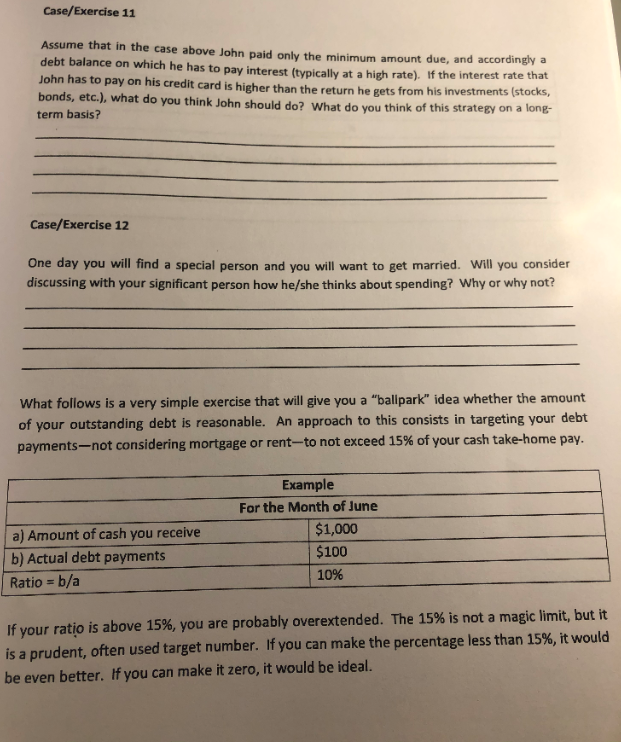

Case/Exercise 10 John has a credit card with a billing period that goes from the 16th of a given month, say, June, to the 15" of the following month (July) with the payment not being due until August 7. What is the most efficient way he can use his card? Case/Exercise 11 Assume that in the case above John paid only the minimum amount due, and according debt balance on which he has to pay interest typically at a high rate). If the interest rate that John has to pay on his credit card is higher than the return he gets from his investments (STOCKS, bonds, etc.), what do you think John should do? What do you think of this strategy on a long- term basis? Case/Exercise 12 One day you will find a special person and you will want to get married. Will you consider discussing with your significant person how he/she thinks about spending? Why or why not? What follows is a very simple exercise that will give you a "ballpark" idea whether the amount of your outstanding debt is reasonable. An approach to this consists in targeting your debt payments-not considering mortgage or rent-to not exceed 15% of your cash take-home pay. a) Amount of cash you receive b) Actual debt payments Ratio = b/a Example For the Month of June $1,000 $100 10% If your ratio is above 15%, you are probably overextended. The 15% is not a magic limit, but it is a prudent, often used target number. If you can make the percentage less than 15%, it would be even better. If you can make it zero, it would be ideal. Case/Exercise 10 John has a credit card with a billing period that goes from the 16th of a given month, say, June, to the 15" of the following month (July) with the payment not being due until August 7. What is the most efficient way he can use his card? Case/Exercise 11 Assume that in the case above John paid only the minimum amount due, and according debt balance on which he has to pay interest typically at a high rate). If the interest rate that John has to pay on his credit card is higher than the return he gets from his investments (STOCKS, bonds, etc.), what do you think John should do? What do you think of this strategy on a long- term basis? Case/Exercise 12 One day you will find a special person and you will want to get married. Will you consider discussing with your significant person how he/she thinks about spending? Why or why not? What follows is a very simple exercise that will give you a "ballpark" idea whether the amount of your outstanding debt is reasonable. An approach to this consists in targeting your debt payments-not considering mortgage or rent-to not exceed 15% of your cash take-home pay. a) Amount of cash you receive b) Actual debt payments Ratio = b/a Example For the Month of June $1,000 $100 10% If your ratio is above 15%, you are probably overextended. The 15% is not a magic limit, but it is a prudent, often used target number. If you can make the percentage less than 15%, it would be even better. If you can make it zero, it would be ideal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts