Question: How to do income tax payable/tax refund? solution should be in format d. Income tax payable / tax refund in respect of Encik Mikhael and

How to do income tax payable/tax refund? solution should be in format

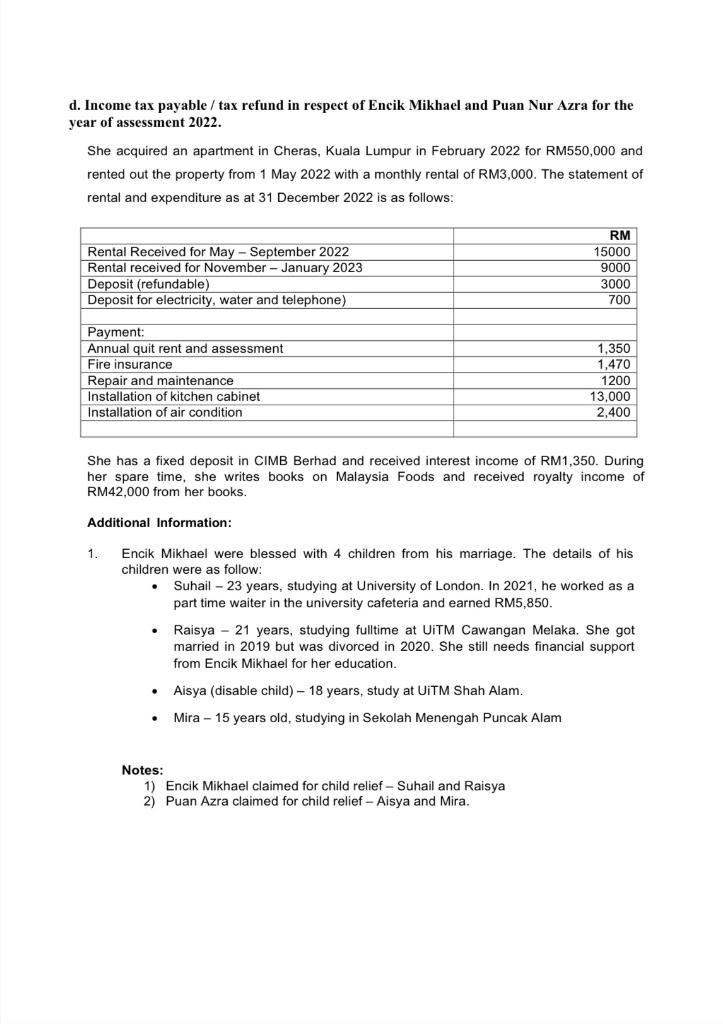

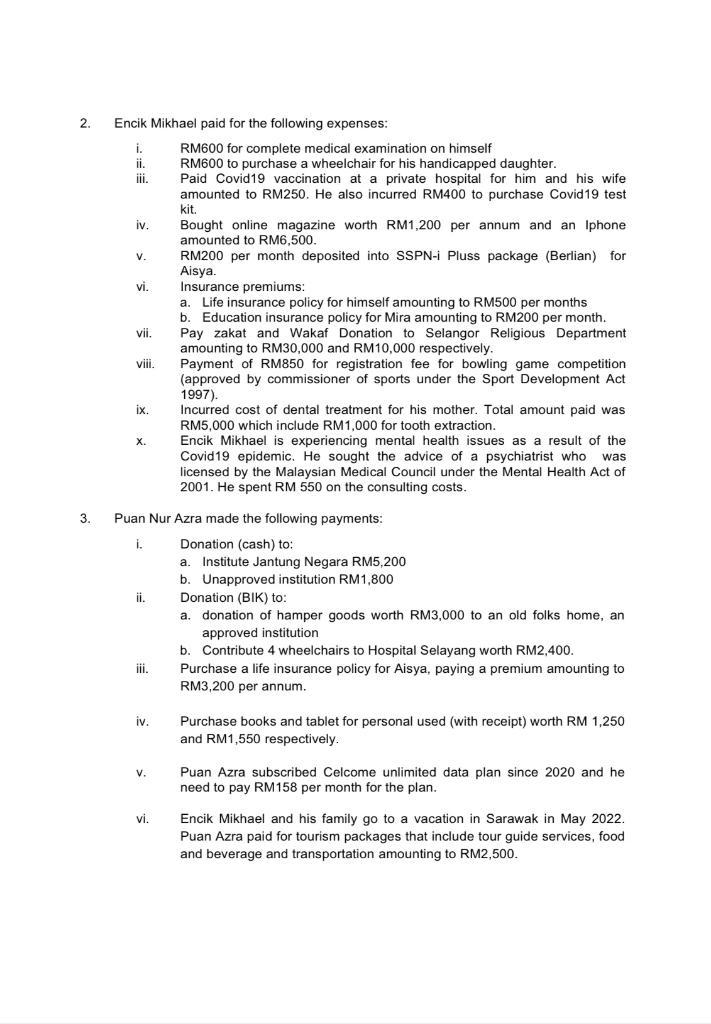

d. Income tax payable / tax refund in respect of Encik Mikhael and Puan Nur Azra for the year of assessment 2022. She acquired an apartment in Cheras, Kuala Lumpur in February 2022 for RM550,000 and rented out the property from 1 May 2022 with a monthly rental of RM3,000. The statement of rental and expenditure as at 31 December 2022 is as follows: Rental Received for May - September 2022 Rental received for November - January 2023 Deposit (refundable) Deposit for electricity, water and telephone) Payment: Annual quit rent and assessment Fire insurance Repair and maintenance Installation of kitchen cabinet Installation of air condition Additional Information: 1. She has a fixed deposit in CIMB Berhad and received interest income of RM1,350. During her spare time, she writes books on Malaysia Foods and received royalty income of RM42,000 from her books. . . RM 15000 9000 3000 700 Encik Mikhael were blessed with 4 children from his marriage. The details of his children were as follow: . 1,350 1,470 1200 13,000 2,400 Notes: 1) Encik Mikhael claimed for child relief- Suhail and Raisya. 2) Puan Azra claimed for child relief - Aisya and Mira. Suhail - 23 years, studying at University of London. In 2021, he worked as a part time waiter in the university cafeteria and earned RM5,850. Raisya 21 years, studying fulltime at UiTM Cawangan Melaka. She got married in 2019 but was divorced in 2020. She still needs financial support from Encik Mikhael for her education. Aisya (disable child) - 18 years, study at UiTM Shah Alam. Mira - 15 years old, studying in Sekolah Menengah Puncak Alam

Step by Step Solution

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Tax Computation for Encik Mikhael Calculate Total Income Rental Income RM15000 MaySeptember RM9000 NovemberJanuary RM24000 Interest Income RM1350 Total Income RM24000 RM1350 RM25350 Deduct Allowable E... View full answer

Get step-by-step solutions from verified subject matter experts