Question: how to do on a financial calculator The Patchmans have decided to invest in a college fund for their young son. They invested $40,000 in

how to do on a financial calculator

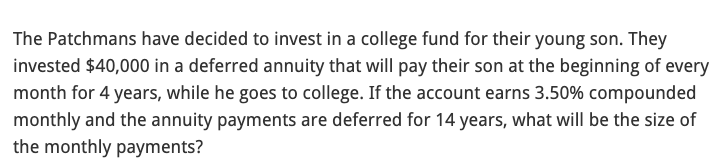

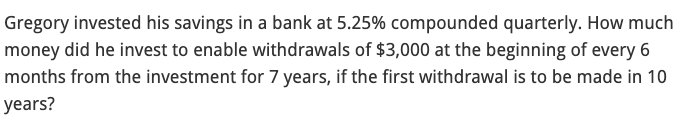

The Patchmans have decided to invest in a college fund for their young son. They invested $40,000 in a deferred annuity that will pay their son at the beginning of every month for 4 years, while he goes to college. If the account earns 3.50% compounded monthly and the annuity payments are deferred for 14 years, what will be the size of the monthly payments? Gregory invested his savings in a bank at 5.25% compounded quarterly. How much money did he invest to enable withdrawals of $3,000 at the beginning of every 6 months from the investment for 7 years, if the first withdrawal is to be made in 10 years? The Patchmans have decided to invest in a college fund for their young son. They invested $40,000 in a deferred annuity that will pay their son at the beginning of every month for 4 years, while he goes to college. If the account earns 3.50% compounded monthly and the annuity payments are deferred for 14 years, what will be the size of the monthly payments? Gregory invested his savings in a bank at 5.25% compounded quarterly. How much money did he invest to enable withdrawals of $3,000 at the beginning of every 6 months from the investment for 7 years, if the first withdrawal is to be made in 10 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts