Question: How to do part b and c pls? ( NOT PART A) How to do part b and c pls? ( NOT PART A) 2.

How to do part b and c pls? ( NOT PART A)

How to do part b and c pls? ( NOT PART A)

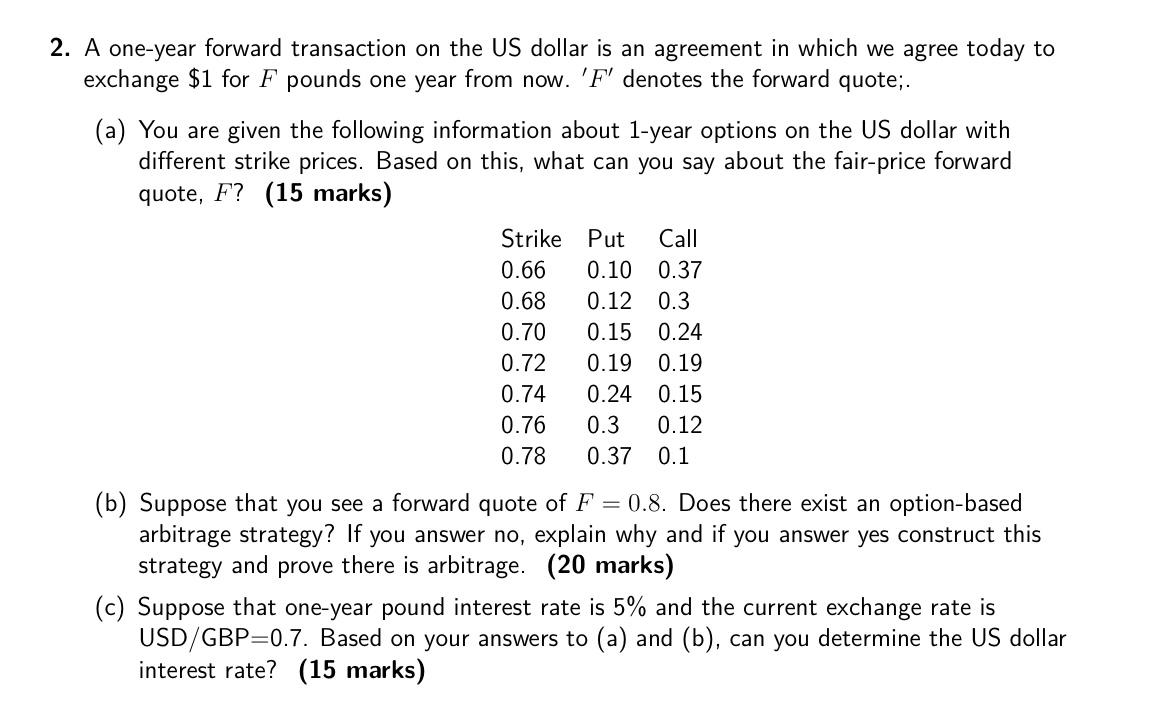

2. A one-year forward transaction on the US dollar is an agreement in which we agree today to exchange $1 for F pounds one year from now. 'F' denotes the forward quote;. (a) You are given the following information about 1-year options on the US dollar with different strike prices. Based on this, what can you say about the fair-price forward quote, F? (15 marks) Strike Put Call 0.66 0.10 0.37 0.68 0.12 0.3 0.70 0.15 0.24 0.72 0.19 0.19 0.74 0.24 0.15 0.76 0.3 0.12 0.78 0.37 0.1 (b) Suppose that you see a forward quote of F = 0.8. Does there exist an option-based arbitrage strategy? If you answer no, explain why and if you answer yes construct this strategy and prove there is arbitrage. (20 marks) (c) Suppose that one-year pound interest rate is 5% and the current exchange rate is USD/GBP=0.7. Based on your answers to (a) and (b), can you determine the US dollar interest rate? (15 marks) 2. A one-year forward transaction on the US dollar is an agreement in which we agree today to exchange $1 for F pounds one year from now. 'F' denotes the forward quote;. (a) You are given the following information about 1-year options on the US dollar with different strike prices. Based on this, what can you say about the fair-price forward quote, F? (15 marks) Strike Put Call 0.66 0.10 0.37 0.68 0.12 0.3 0.70 0.15 0.24 0.72 0.19 0.19 0.74 0.24 0.15 0.76 0.3 0.12 0.78 0.37 0.1 (b) Suppose that you see a forward quote of F = 0.8. Does there exist an option-based arbitrage strategy? If you answer no, explain why and if you answer yes construct this strategy and prove there is arbitrage. (20 marks) (c) Suppose that one-year pound interest rate is 5% and the current exchange rate is USD/GBP=0.7. Based on your answers to (a) and (b), can you determine the US dollar interest rate? (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts