Question: How to do part c please? (NOT PART B) 3. Netaf is a public firm that specializes in advanced irrigation techniques. Current shareholders receive an

How to do part c please? (NOT PART B)

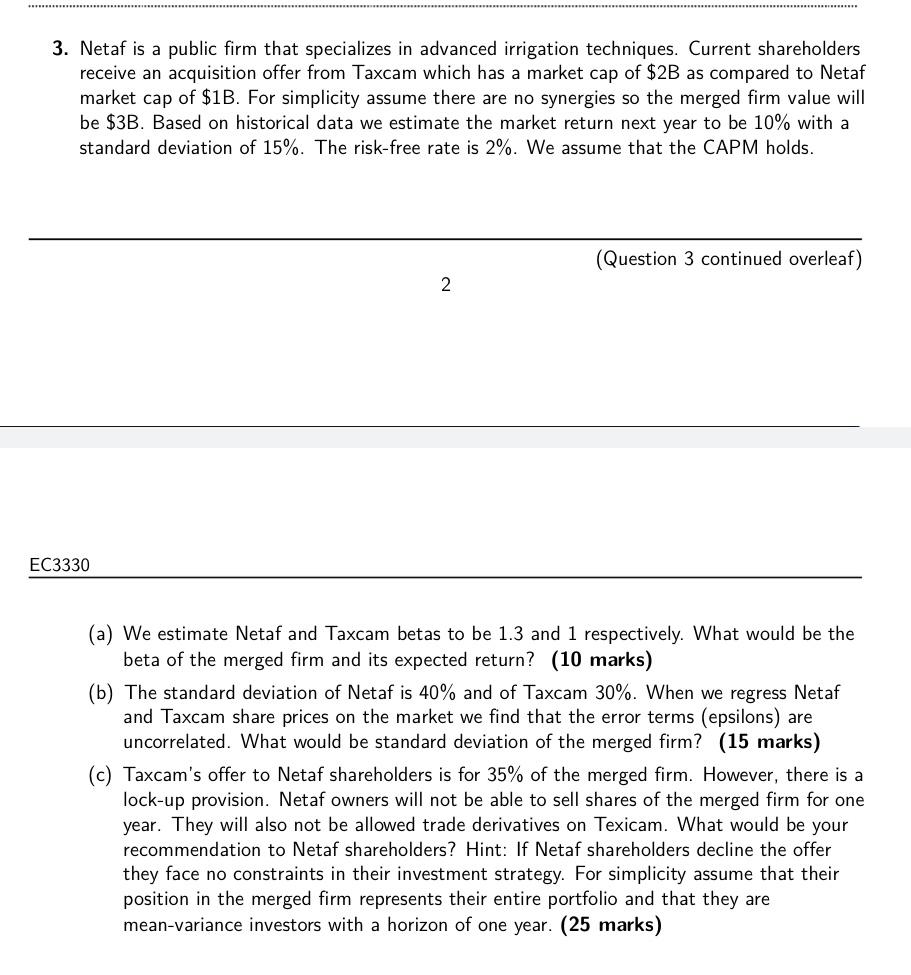

3. Netaf is a public firm that specializes in advanced irrigation techniques. Current shareholders receive an acquisition offer from Taxcam which has a market cap of $2B as compared to Netaf market cap of $1B. For simplicity assume there are no synergies so the merged firm value will be $3B. Based on historical data we estimate the market return next year to be 10% with a standard deviation of 15%. The risk-free rate is 2%. We assume that the CAPM holds. (Question 3 continued overleaf) 2 EC3330 (a) We estimate Netaf and Taxcam betas to be 1.3 and 1 respectively. What would be the beta of the merged firm and its expected return? (10 marks) (b) The standard deviation of Netaf is 40% and of Taxcam 30%. When we regress Netaf and Taxcam share prices on the market we find that the error terms (epsilons) are uncorrelated. What would be standard deviation of the merged firm? (15 marks) (c) Taxcam's offer to Netaf shareholders is for 35% of the merged firm. However, there is a lock-up provision. Netaf owners will not be able to sell shares of the merged firm for one year. They will also not be allowed trade derivatives on Texicam. What would be your recommendation to Netaf shareholders? Hint: If Netaf shareholders decline the offer they face no constraints in their investment strategy. For simplicity assume that their position in the merged firm represents their entire portfolio and that they are mean-variance investors with a horizon of one year. (25 marks) 3. Netaf is a public firm that specializes in advanced irrigation techniques. Current shareholders receive an acquisition offer from Taxcam which has a market cap of $2B as compared to Netaf market cap of $1B. For simplicity assume there are no synergies so the merged firm value will be $3B. Based on historical data we estimate the market return next year to be 10% with a standard deviation of 15%. The risk-free rate is 2%. We assume that the CAPM holds. (Question 3 continued overleaf) 2 EC3330 (a) We estimate Netaf and Taxcam betas to be 1.3 and 1 respectively. What would be the beta of the merged firm and its expected return? (10 marks) (b) The standard deviation of Netaf is 40% and of Taxcam 30%. When we regress Netaf and Taxcam share prices on the market we find that the error terms (epsilons) are uncorrelated. What would be standard deviation of the merged firm? (15 marks) (c) Taxcam's offer to Netaf shareholders is for 35% of the merged firm. However, there is a lock-up provision. Netaf owners will not be able to sell shares of the merged firm for one year. They will also not be allowed trade derivatives on Texicam. What would be your recommendation to Netaf shareholders? Hint: If Netaf shareholders decline the offer they face no constraints in their investment strategy. For simplicity assume that their position in the merged firm represents their entire portfolio and that they are mean-variance investors with a horizon of one year. (25 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts