Question: How to do Q13 entry loci 31 Ihcludes a (a) debit to Interest Payable. (b) credit to Cash. (c) credit to Interest Expense. BP 100,000

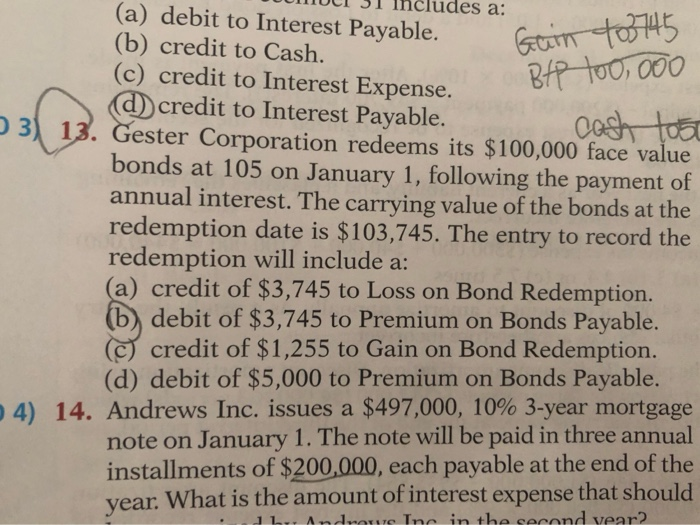

loci 31 Ihcludes a (a) debit to Interest Payable. (b) credit to Cash. (c) credit to Interest Expense. BP 100,000 credit to Interest Payable. 93 1.3. Gester Corporation redeems its $100,000 face value bonds at 105 on January 1, following the payment of annual interest. The carrying value of the bonds at the redemption date is $103,745. The entry to record the redemption will include a: a) credit of $3,745 to Loss on Bond Redemption. b debit of $3,745 to Premium on Bonds Payable. c) credit of $1,255 to Gain on Bond Redemption. (d) debit of $5,000 to Premium on Bonds Payable. 4) 14. Andrews Inc. issues a $497,000, 10% 3-year mortgage note on January 1. The note will be paid in three annual installments of $200,000, each payable at the end of the year: What is the amount of interest expense that should 1, And Tne in the second vear

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts