Question: How to do question number 5? 4. You are considering purchasing a bond at the end of this year. The bond's interest payments ($105) are

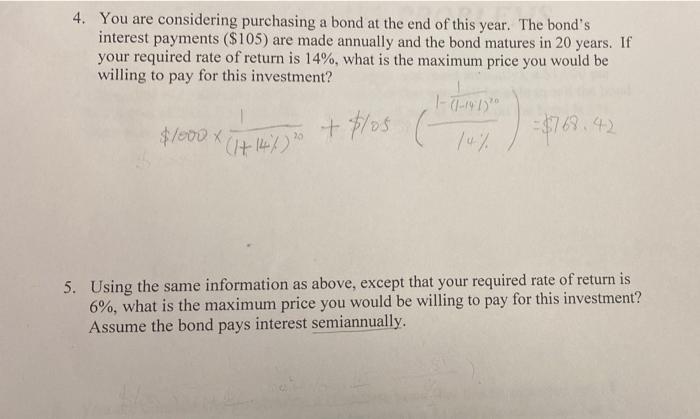

4. You are considering purchasing a bond at the end of this year. The bond's interest payments ($105) are made annually and the bond matures in 20 years. If your required rate of return is 14%, what is the maximum price you would be willing to pay for this investment? 1-11-14 100 x 74% =$763,42 + His chemins ago > 5. Using the same information as above, except that your required rate of return is 6%, what is the maximum price you would be willing to pay for this investment? Assume the bond pays interest semiannually

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts