Question: How to do the equity analysis of case study? Question 1 Yuenson Holdings Berhad (Yuenson) is a Malaysian company in the upstream oil and gas

How to do the equity analysis of case study?

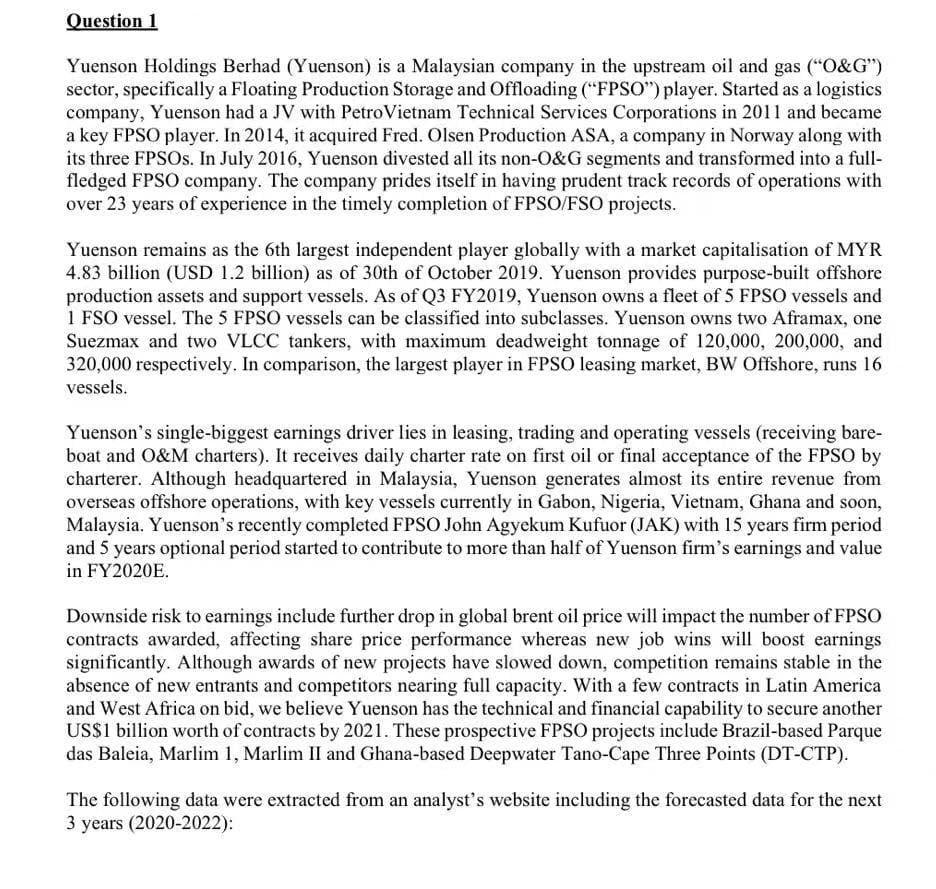

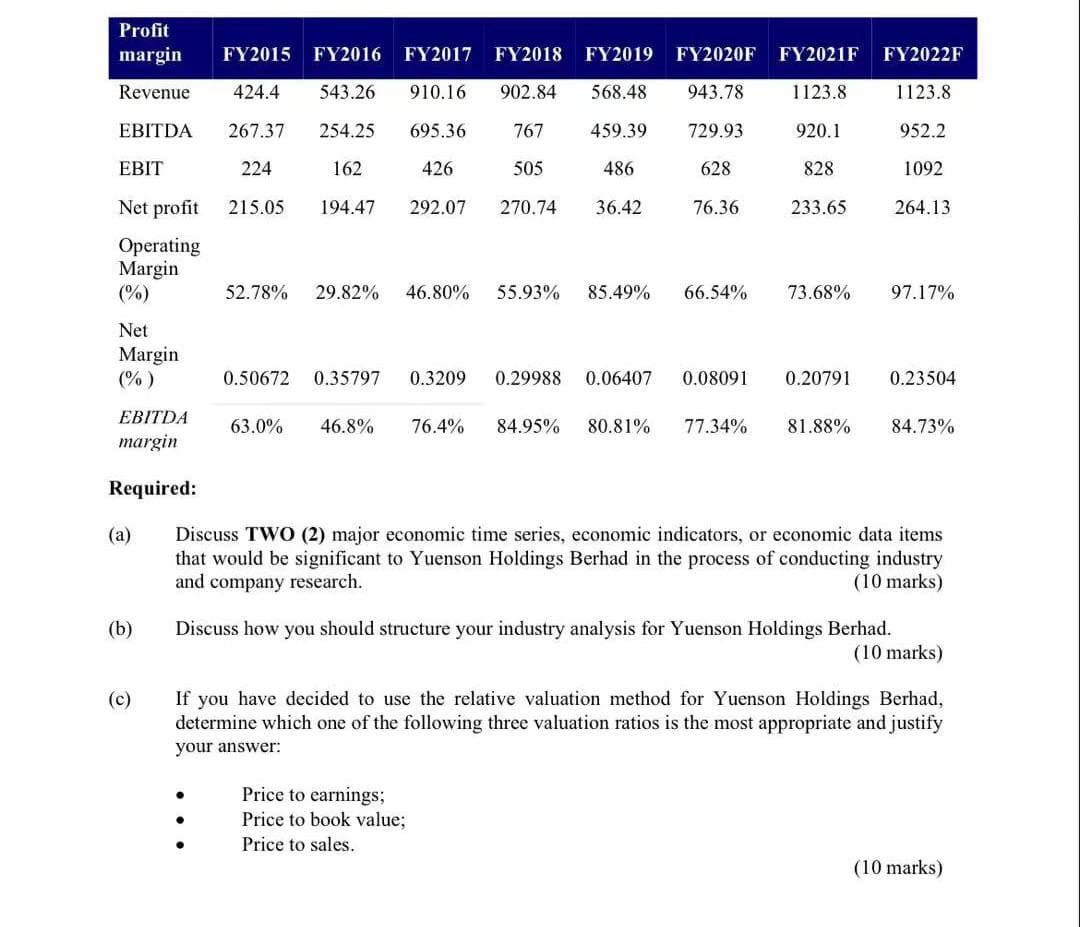

Question 1 Yuenson Holdings Berhad (Yuenson) is a Malaysian company in the upstream oil and gas ("O&G) sector, specifically a Floating Production Storage and Offloading (FPSO") player. Started as a logistics company, Yuenson had a JV with PetroVietnam Technical Services Corporations in 2011 and became a key FPSO player. In 2014, it acquired Fred. Olsen Production ASA, a company in Norway along with its three FPSOs. In July 2016, Yuenson divested all its non-O&G segments and transformed into a full- fledged FPSO company. The company prides itself in having prudent track records of operations with over 23 years of experience in the timely completion of FPSO/FSO projects. Yuenson remains as the 6th largest independent player globally with a market capitalisation of MYR 4.83 billion (USD 1.2 billion) as of 30th of October 2019. Yuenson provides purpose-built offshore production assets and support vessels. As of Q3 FY2019, Yuenson owns a fleet of 5 FPSO vessels and 1 FSO vessel. The 5 FPSO vessels can be classified into subclasses. Yuenson owns two Aframax, one Suezmax and two VLCC tankers, with maximum deadweight tonnage of 120,000, 200,000, and 320,000 respectively. In comparison, the largest player in FPSO leasing market, BW Offshore, runs 16 vessels. Yuenson's single-biggest earnings driver lies in leasing, trading and operating vessels (receiving bare- boat and O&M charters). It receives daily charter rate on first oil or final acceptance of the FPSO by charterer. Although headquartered in Malaysia, Yuenson generates almost its entire revenue from overseas offshore operations, with key vessels currently in Gabon, Nigeria, Vietnam, Ghana and soon, Malaysia. Yuenson's recently completed FPSO John Agyekum Kufuor (JAK) with 15 years firm period and 5 years optional period started to contribute to more than half of Yuenson firm's earnings and value in FY2020E. Downside risk to earnings include further drop in global brent oil price will impact the number of FPSO contracts awarded, affecting share price performance whereas new job wins will boost earnings significantly. Although awards of new projects have slowed down, competition remains stable in the absence of new entrants and competitors nearing full capacity. With a few contracts in Latin America and West Africa on bid, we believe Yuenson has the technical and financial capability to secure another US$1 billion worth of contracts by 2021. These prospective FPSO projects include Brazil-based Parque das Baleia, Marlim 1, Marlim II and Ghana-based Deepwater Tano-Cape Three Points (DT-CTP). The following data were extracted from an analyst's website including the forecasted data for the next 3 years (2020-2022): Profit margin FY2015 FY2016 FY2017 FY2018 FY2019 FY2020F FY2021F FY2022F Revenue 424.4 543.26 910.16 902.84 568.48 943.78 1123.8 1123.8 EBITDA 267.37 254.25 695.36 767 459.39 729.93 920.1 952.2 EBIT 224 162 426 505 486 628 828 1092 Net profit 215.05 194.47 292.07 270.74 36.42 76.36 233.65 264.13 Operating Margin (%) 52.78% 29.82% 46.80% 55.93% 85.49% 66.54% 73.68% 97.17% Net Margin (%) 0.50672 0.35797 0.3209 0.29988 0.06407 0.08091 0.20791 0.23504 EBITDA margin 63.0% 46.8% 76.4% 84.95% 80.81% 77.34% 81.88% 84.73% Required: (a) Discuss TWO (2) major economic time series, economic indicators, or economic data items that would be significant to Yuenson Holdings Berhad in the process of conducting industry and company research. (10 marks) (b) Discuss how you should structure your industry analysis for Yuenson Holdings Berhad. (10 marks) (c) If you have decided to use the relative valuation method for Yuenson Holdings Berhad, determine which one of the following three valuation ratios is the most appropriate and justify your answer: Price to earnings; Price to book value; Price to sales. (10 marks) Question 1 Yuenson Holdings Berhad (Yuenson) is a Malaysian company in the upstream oil and gas ("O&G) sector, specifically a Floating Production Storage and Offloading (FPSO") player. Started as a logistics company, Yuenson had a JV with PetroVietnam Technical Services Corporations in 2011 and became a key FPSO player. In 2014, it acquired Fred. Olsen Production ASA, a company in Norway along with its three FPSOs. In July 2016, Yuenson divested all its non-O&G segments and transformed into a full- fledged FPSO company. The company prides itself in having prudent track records of operations with over 23 years of experience in the timely completion of FPSO/FSO projects. Yuenson remains as the 6th largest independent player globally with a market capitalisation of MYR 4.83 billion (USD 1.2 billion) as of 30th of October 2019. Yuenson provides purpose-built offshore production assets and support vessels. As of Q3 FY2019, Yuenson owns a fleet of 5 FPSO vessels and 1 FSO vessel. The 5 FPSO vessels can be classified into subclasses. Yuenson owns two Aframax, one Suezmax and two VLCC tankers, with maximum deadweight tonnage of 120,000, 200,000, and 320,000 respectively. In comparison, the largest player in FPSO leasing market, BW Offshore, runs 16 vessels. Yuenson's single-biggest earnings driver lies in leasing, trading and operating vessels (receiving bare- boat and O&M charters). It receives daily charter rate on first oil or final acceptance of the FPSO by charterer. Although headquartered in Malaysia, Yuenson generates almost its entire revenue from overseas offshore operations, with key vessels currently in Gabon, Nigeria, Vietnam, Ghana and soon, Malaysia. Yuenson's recently completed FPSO John Agyekum Kufuor (JAK) with 15 years firm period and 5 years optional period started to contribute to more than half of Yuenson firm's earnings and value in FY2020E. Downside risk to earnings include further drop in global brent oil price will impact the number of FPSO contracts awarded, affecting share price performance whereas new job wins will boost earnings significantly. Although awards of new projects have slowed down, competition remains stable in the absence of new entrants and competitors nearing full capacity. With a few contracts in Latin America and West Africa on bid, we believe Yuenson has the technical and financial capability to secure another US$1 billion worth of contracts by 2021. These prospective FPSO projects include Brazil-based Parque das Baleia, Marlim 1, Marlim II and Ghana-based Deepwater Tano-Cape Three Points (DT-CTP). The following data were extracted from an analyst's website including the forecasted data for the next 3 years (2020-2022): Profit margin FY2015 FY2016 FY2017 FY2018 FY2019 FY2020F FY2021F FY2022F Revenue 424.4 543.26 910.16 902.84 568.48 943.78 1123.8 1123.8 EBITDA 267.37 254.25 695.36 767 459.39 729.93 920.1 952.2 EBIT 224 162 426 505 486 628 828 1092 Net profit 215.05 194.47 292.07 270.74 36.42 76.36 233.65 264.13 Operating Margin (%) 52.78% 29.82% 46.80% 55.93% 85.49% 66.54% 73.68% 97.17% Net Margin (%) 0.50672 0.35797 0.3209 0.29988 0.06407 0.08091 0.20791 0.23504 EBITDA margin 63.0% 46.8% 76.4% 84.95% 80.81% 77.34% 81.88% 84.73% Required: (a) Discuss TWO (2) major economic time series, economic indicators, or economic data items that would be significant to Yuenson Holdings Berhad in the process of conducting industry and company research. (10 marks) (b) Discuss how you should structure your industry analysis for Yuenson Holdings Berhad. (10 marks) (c) If you have decided to use the relative valuation method for Yuenson Holdings Berhad, determine which one of the following three valuation ratios is the most appropriate and justify your answer: Price to earnings; Price to book value; Price to sales. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts