Question: How to do the working out for this question, for property investment course, as i dont remember how i got my answer want to know

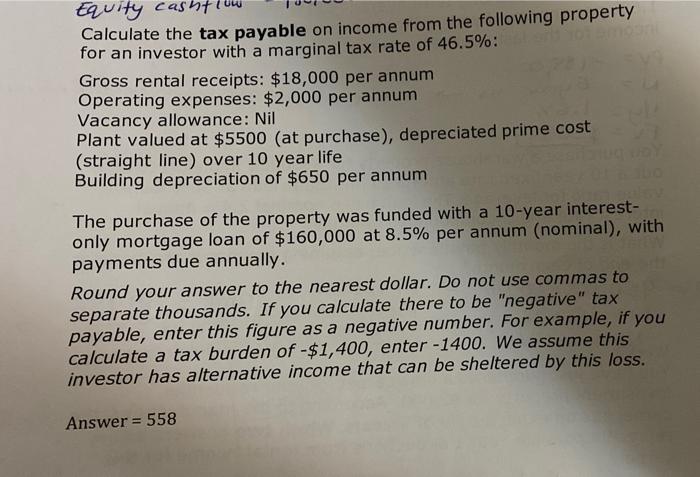

Equity casht! Calculate the tax payable on income from the following property for an investor with a marginal tax rate of 46.5%: Gross rental receipts: $18,000 per annum Operating expenses: $2,000 per annum Vacancy allowance: Nil Plant valued at $5500 (at purchase), depreciated prime cost (straight line) over 10 year life Building depreciation of $650 per annum The purchase of the property was funded with a 10-year interest- only mortgage loan of $160,000 at 8.5% per annum (nominal), with payments due annually. Round your answer to the nearest dollar. Do not use commas to separate thousands. If you calculate there to be "negative" tax payable, enter this figure as a negative number. For example, if you calculate a tax burden of $1,400, enter -1400. We assume this investor has alternative income that can be sheltered by this loss. Answer = 558

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts