Question: how to do this in a excel spreadsheet Consider the following loan information. - Total acquisition price: $3,000,000. - Property consists of twelve office suites,

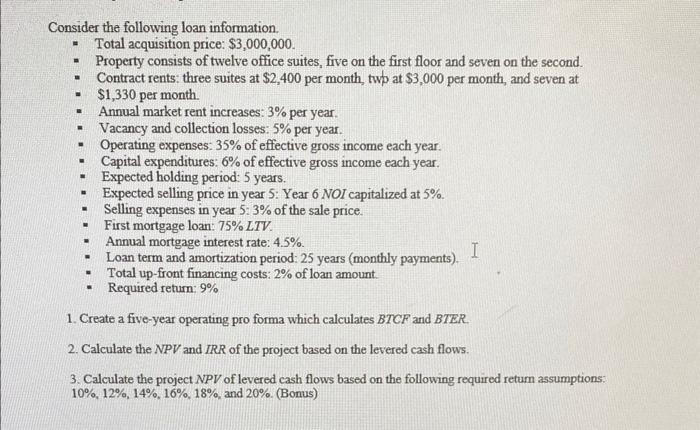

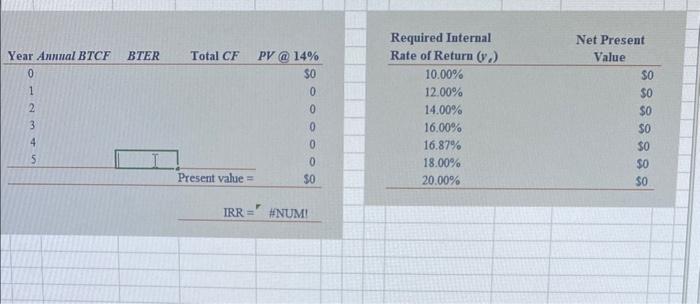

Consider the following loan information. - Total acquisition price: $3,000,000. - Property consists of twelve office suites, five on the first floor and seven on the second. - Contract rents: three suites at $2,400 per month, twp at $3,000 per month, and seven at - $1,330 per month. - Annual market rent increases: 3% per year. - Vacancy and collection losses: 5% per year. - Operating expenses: 35% of effective gross income each year. - Capital expenditures: 6% of effective gross income each year. - Expected holding period: 5 years. - Expected selling price in year 5: Year 6 NOI capitalized at 5%. - Selling expenses in year 5:3% of the sale price. - First mortgage loan: 75% LTV. - Annual mortgage interest rate: 4.5%. - Loan term and amortization period: 25 years (monthly payments). - Total up-front financing costs: 2% of loan amount. - Required return: 9% 1. Create a five-year operating pro forma which calculates BTCF and BTER. 2. Calculate the NPV and IRR of the project based on the levered cash flows. 3. Calculate the project NPV of levered cash flows based on the following required retum assumptions: 10%,12%,14%,16%,18%, and 20%. (Bonus) IRR = " \#NUM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts