Question: How to do this question? Please! Let r_1 and r_2 be the random returns on stocks 1 and 2, respectively, with standard deviations sigma_1 and

How to do this question? Please!

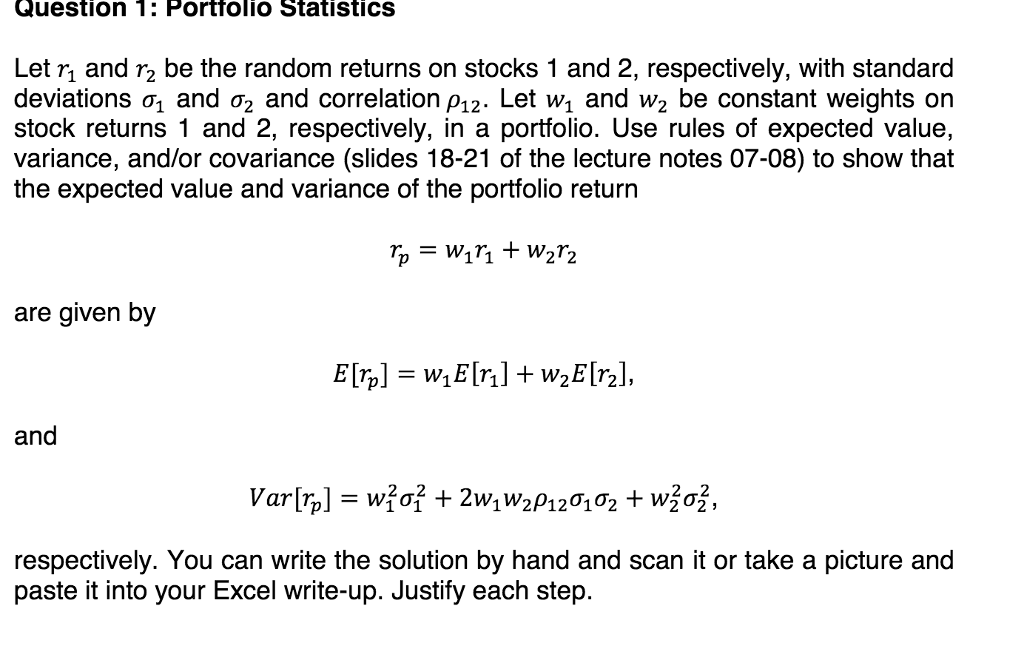

Let r_1 and r_2 be the random returns on stocks 1 and 2, respectively, with standard deviations sigma_1 and sigma_2 and correlation rho_12. Let w_1 and w_2 be constant weights on stock returns 1 and 2, respectively, in a portfolio. Use rules of expected value, variance, and/or covariance (slides 18-21 of the lecture notes 07-08) to show that the expected value and variance of the portfolio return r_p = w_1 r_1 + w_2 r_2 are given by E[r_p] = w_1 [r_1] + w_2 E[r_2], and Var[r_p] = w_1^2 sigma_1^2 + 2 w_1 w_2 rho_12 sigma_1 sigma_2 + w_2^2 sigma_2^2 respectively. You can write the solution by hand and scan it or take a picture and paste it into your Excel write-up. Justify each step. Let r_1 and r_2 be the random returns on stocks 1 and 2, respectively, with standard deviations sigma_1 and sigma_2 and correlation rho_12. Let w_1 and w_2 be constant weights on stock returns 1 and 2, respectively, in a portfolio. Use rules of expected value, variance, and/or covariance (slides 18-21 of the lecture notes 07-08) to show that the expected value and variance of the portfolio return r_p = w_1 r_1 + w_2 r_2 are given by E[r_p] = w_1 [r_1] + w_2 E[r_2], and Var[r_p] = w_1^2 sigma_1^2 + 2 w_1 w_2 rho_12 sigma_1 sigma_2 + w_2^2 sigma_2^2 respectively. You can write the solution by hand and scan it or take a picture and paste it into your Excel write-up. Justify each step

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts