Question: How to do this question? teach me how to get the answer.. Is there any formula need to use? The balance sheet of the Grace

How to do this question? teach me how to get the answer..

Is there any formula need to use?

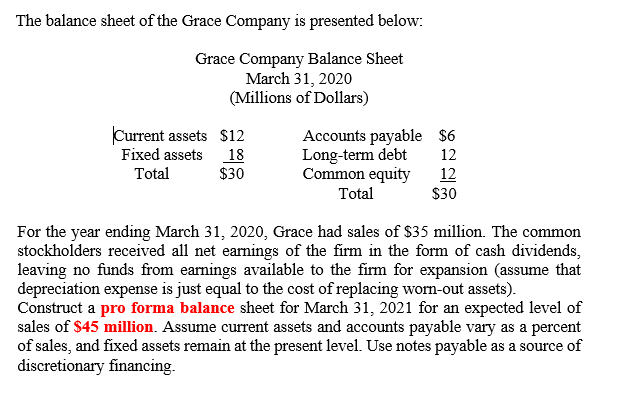

The balance sheet of the Grace Company is presented below: Grace Company Balance Sheet March 31, 2020 (Millions of Dollars) Current assets $12 Fixed assets 18 Total $30 Accounts payable $6 Long-term debt 12 Common equity 12 Total $30 For the year ending March 31, 2020, Grace had sales of $35 million. The commo stockholders received all net earnings of the firm in the form of cash dividends, leaving no funds from earnings available to the firm for expansion (assume that depreciation expense is just equal to the cost of replacing worn-out assets). Construct a pro forma balance sheet for March 31, 2021 for an expected level of sales of $45 million. Assume current assets and accounts payable vary as a percent of sales, and fixed assets remain at the present level. Use notes payable as a source of discretionary financing The balance sheet of the Grace Company is presented below: Grace Company Balance Sheet March 31, 2020 (Millions of Dollars) Current assets $12 Fixed assets 18 Total $30 Accounts payable $6 Long-term debt 12 Common equity 12 Total $30 For the year ending March 31, 2020, Grace had sales of $35 million. The commo stockholders received all net earnings of the firm in the form of cash dividends, leaving no funds from earnings available to the firm for expansion (assume that depreciation expense is just equal to the cost of replacing worn-out assets). Construct a pro forma balance sheet for March 31, 2021 for an expected level of sales of $45 million. Assume current assets and accounts payable vary as a percent of sales, and fixed assets remain at the present level. Use notes payable as a source of discretionary financing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts