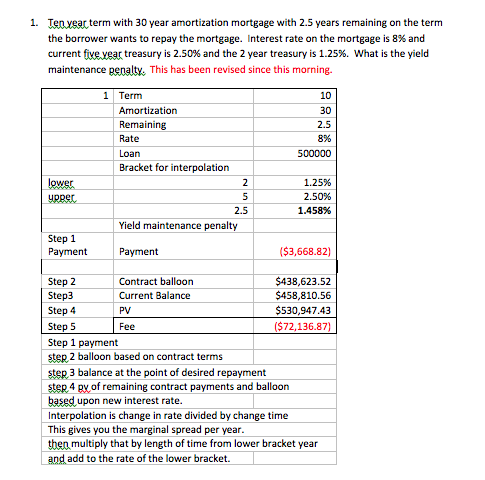

Question: How to get the 1.458%. Please help! 1. eear term with 30 year amortization mortgage with 2.5 years remaining on the term the borrower wants

How to get the 1.458%. Please help!

1. eear term with 30 year amortization mortgage with 2.5 years remaining on the term the borrower wants to repay the mortgage. Interest rate on the mortgage is 8% and current txexeac treasury is 2.50% and the 2 year treasury is 1.25%. What is the yield maintenance penalty, This has been revised since this morning. 1 Term Amortization Remaining Rate 10 30 2.5 8% Bracket for interpolation 1.25% 2.50% 1.458% 2.5 Yield maintenance penalty Step 1 Payment ($3,668.82) 438,623.52 $458,810.56 S530,947.43 72,136.87 Step 2 Step3 Step 4 Step 5 Step 1 payment step 2 balloon based on contract terms step 3 balance at the point of desired repayment step 4 pv of remaining contract payments and balloon based upon new interest rate. Interpolation is change in rate divided by change time This gives you the marginal spread per year. tben multiply that by length of time from lower bracket year Contract balloor Current Balance PV Fee add to the rate of the lower bracket

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts