Question: HOW TO GET THE ANSWER $2090.50 UNDER LOGBOOK METHOD? PLEASE SHOW THE STEP BY STEP AND HOW TO CALCULATE IT OUT INCLUDING THE CENTS PER

HOW TO GET THE ANSWER $2090.50 UNDER

LOGBOOK METHOD?

PLEASE SHOW THE STEP BY STEP AND HOW

TO CALCULATE IT OUT INCLUDING THE CENTS PER KM METHOD ?

Why the answwr is Work-related car expense: $2,090.50 [(3,800 +

500) $0.72 per km 10%] and how to get the answer and how to calculate out is $2090.50? please plase show the step by step correctly .

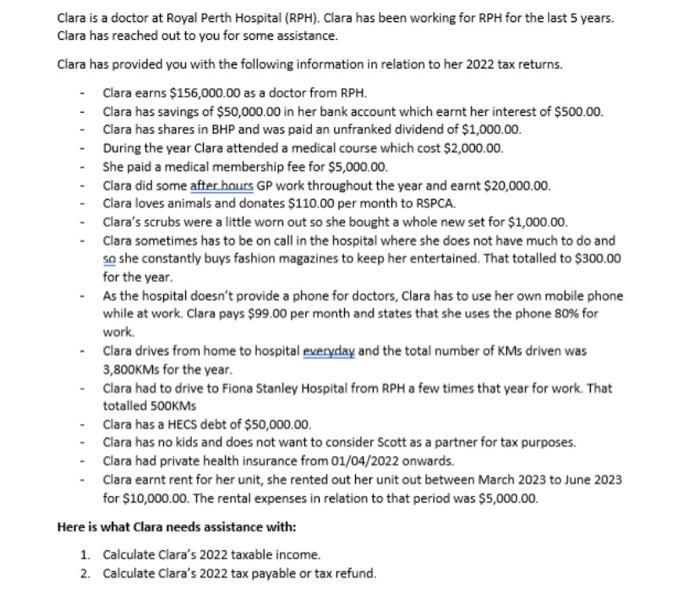

Clara is a doctor at Royal Perth Hospital (RPH). Clara has been working for RPH for the last 5 years. Clara has reached out to you for some assistance. Clara has provided you with the following information in relation to her 2022 tax returns. - Clara earns $156,000.00 as a doctor from RPH. - Clara has savings of $50,000.00 in her bank account which earnt her interest of $500.00. - Clara has shares in BHP and was paid an unfranked dividend of $1,000.00. - During the year Clara attended a medical course which cost $2,000.00. - She paid a medical membership fee for $5,000.00. - Clara did some after hours GP work throughout the year and earnt $20,000.00. - Clara loves animals and donates $110.00 per month to RSPCA. - Clara's scrubs were a little worn out so she bought a whole new set for $1,000.00. - Clara sometimes has to be on call in the hospital where she does not have much to do and so she constantly buys fashion magazines to keep her entertained. That totalled to $300.00 for the year. - As the hospital doesn't provide a phone for doctors, Clara has to use her own mobile phone while at work. Clara pays $99.00 per month and states that she uses the phone 80% for work. - Clara drives from home to hospital everyday and the total number of KMs driven was 3,800KMs for the year. - Clara had to drive to Fiona Stanley Hospital from RPH a few times that year for work. That totalled 500KMs - Clara has a HECS debt of $50,000.00. - Clara has no kids and does not want to consider Scott as a partner for tax purposes. - Clara had private health insurance from 01/04/2022 onwards. - Clara earnt rent for her unit, she rented out her unit out between March 2023 to June 2023 for $10,000.00. The rental expenses in relation to that period was $5,000.00. Here is what Clara needs assistance with: 1. Calculate Clara's 2022 taxable income. 2. Calculate Clara's 2022 tax payable or tax refund

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts