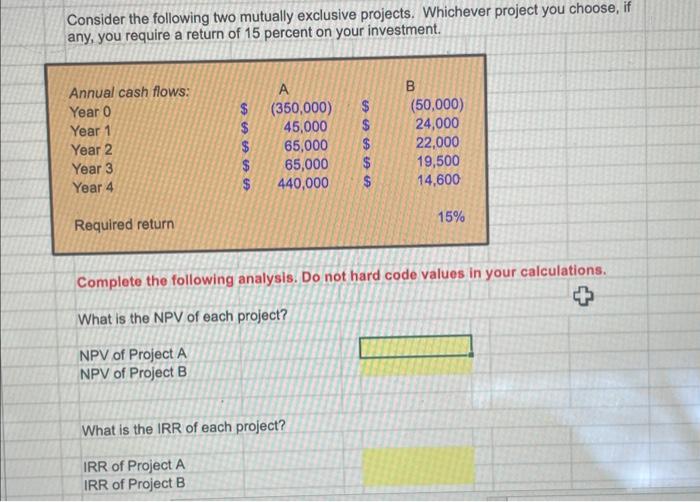

Question: how to input this on excel? having some trouble with part b of this question. Consider the following two mutually exclusive projects. Whichever project you

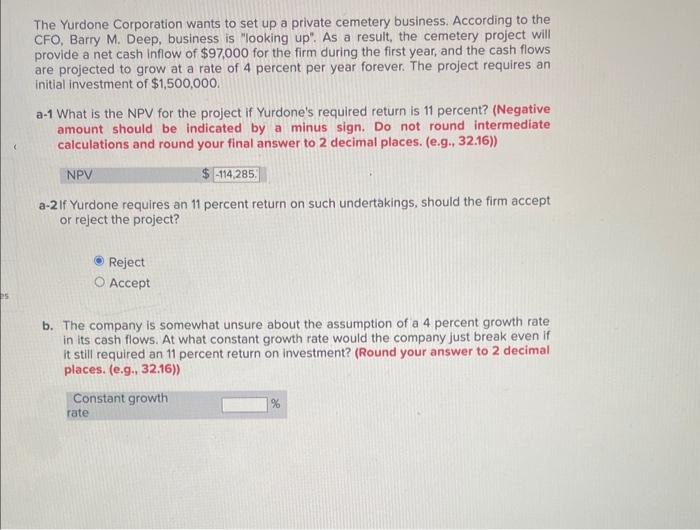

Consider the following two mutually exclusive projects. Whichever project you choose, if any, you require a return of 15 percent on your investment. Complete the following analysis. Do not hard code values in your calculations. The Yurdone Corporation wants to set up a private cemetery business. According to the CFO, Barry M. Deep, business is "looking up". As a result, the cemetery project will provide a net cash inflow of $97,000 for the firm during the first year, and the cash flows are projected to grow at a rate of 4 percent per year forever. The project requires an initial investment of $1,500,000 a-1 What is the NPV for the project if Yurdone's required return is 11 percent? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your final answer to 2 decimal places. (e.g. 32.16)) a-2 If Yurdone requires an 11 percent return on such undertakings, should the firm accept or reject the project? Reject Accept b. The company is somewhat unsure about the assumption of a 4 percent growth rate in its cash flows. At what constant growth rate would the company just break even if it still required an 11 percent return on investment? (Round your answer to 2 decimal places. (e.g., 32.16))

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts