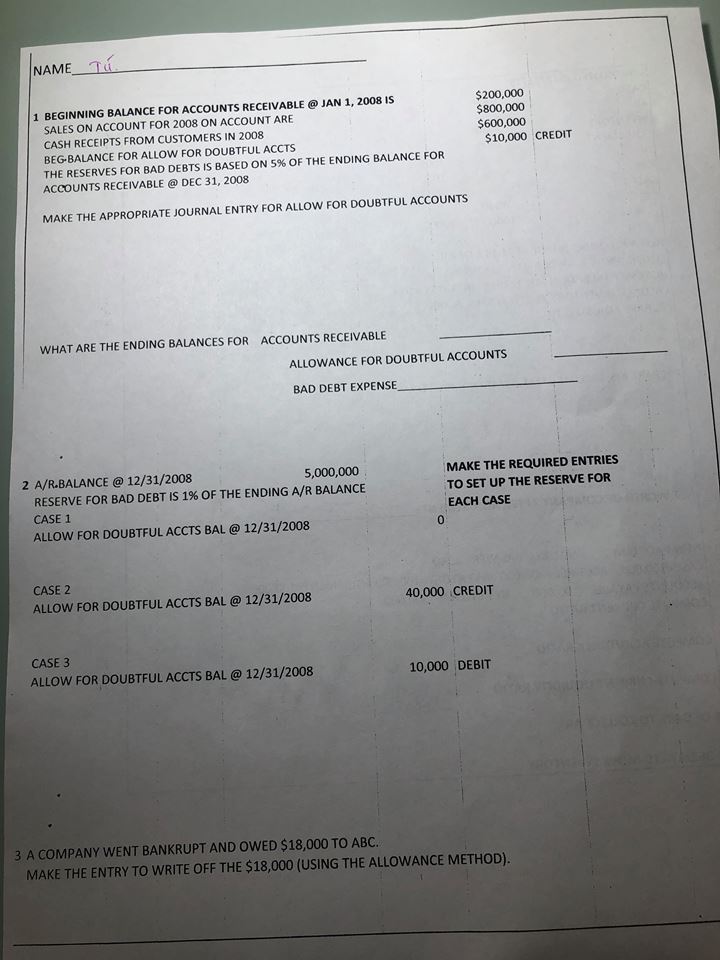

Question: How to make the appropriate journal entry for Allow for Doubtfull Accounts? NAME_ TU $200, 0 001 I BEGINNING BALANCE FOR ACCOUNTS RECEIVABLE @ JAN

How to make the appropriate journal entry for Allow for Doubtfull Accounts?

NAME_ TU $200, 0 001 I BEGINNING BALANCE FOR ACCOUNTS RECEIVABLE @ JAN 1 , 2008 15 $8.00. 0100 SALES ON ACCOUNT FOR ZOOB ON ACCOUNT ARE $600, 0.00 CASH RECEIPTS FROM CUSTOMERS IN 20:08\\ $10, 000 CREDIT BEGBALANCE FOR ALLOW FOR DOUBTFUL ACCTS THE RESERVES FOR BAD DEBTS IS BASED ON 5X6 OF THE ENDING BALANCE FOR ACCOUNTS RECEIVABLE @ DEC 31 , 2008\\ MAKE THE APPROPRIATE JOURNAL ENTRY FOR ALLOW FOR DOUBTFUL ACCOUNTS WHAT ARE THE ENDING BALANCES FOR ACCOUNTS RECEIVABLE ALLOWANCE FOR DOUBTFUL ACCOUNTS BAD DEBT EXPENSE 5, 000, 0.00 MAKE THE REQUIRED ENTRIES 2 A/R. BALANCE @ 12 / 31 / 2008\\ RESERVE FOR BAD DEBT IS 186 OF THE ENDING A / R. BALANCE TO SET UP THE RESERVE FOR EACH CASE CASE I ALLOW FOR DOUBTFUL ACCTS BAL @ 12 / 31 / 20:08 CASE 2 ALLOW FOR DOUBTFUL ACCTS BAL @ 12 / 31 / 20.08 40, 000 CREDIT CASE 3 ALLOW FOR DOUBTFUL ACCTS BAL @ 12 / 31 / 20:08 10, 000 DEBIT 3 A COMPANY WENT BANKRUPT AND OWED $18, 00 0 TO ABC . MAKE THE ENTRY TO WRITE OFF THE $18 , DOD ( USING THE ALLOWANCE METHOD )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts