Question: How to solve Current Attempt in Progress Oriole Company has recorded bad debt expense in the past at a rate of 1 . 5 %

How to solve

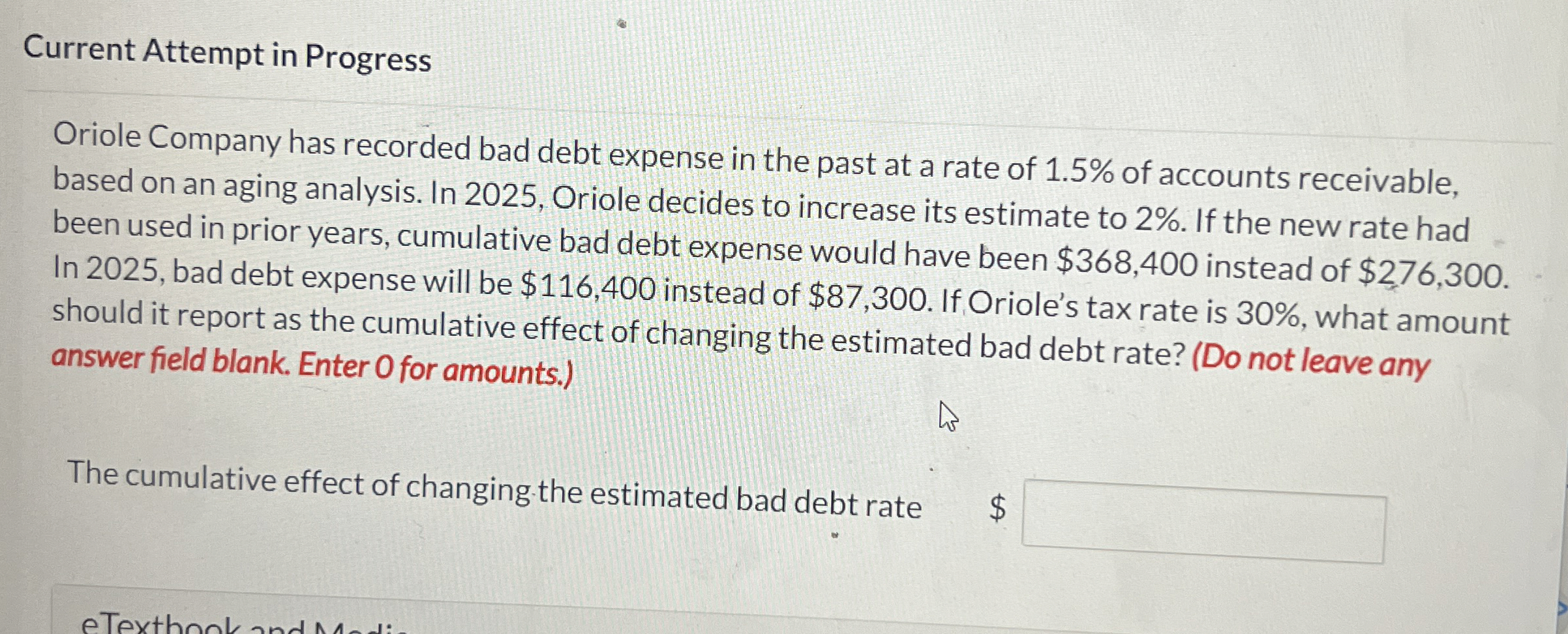

Current Attempt in Progress

Oriole Company has recorded bad debt expense in the past at a rate of of accounts receivable,

based on an aging analysis. In Oriole decides to increase its estimate to If the new rate had

been used in prior years, cumulative bad debt expense would have been $ instead of $

In bad debt expense will be $ instead of $ If Oriole's tax rate is what amount

should it report as the cumulative effect of changing the estimated bad debt rate? Do not leave any

answer field blank. Enter for amounts.

The cumulative effect of changing the estimated bad debt rate $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock